A weak U.S. dollar strengthens copper’s value

Copper prices rose 0.2% on the London Metal Exchange (LME) and traded 1.2% higher at the start of the month, driven by a weaker U.S. dollar, higher import premiums and expectations of slower refined copper production. This morning, copper opened at $4.51.

Why it matters: The dollar is weaker due to speculation the Federal Reserve may cut rates in September, making dollar-priced commodities, like copper, cheaper for international buyers. Rising U.S. copper import premiums suggest a tighter supply, while analysts also expect slower production to continue to support copper’s rise.

Copper mine production continues to face environmental and social complexities.

- A U.S. appeals court temporarily blocked the land exchange scheduled for August 19, delaying the Resolution copper mine in Arizona, after a coalition of the San Carlos Apache people and environmental advocacy groups filed an appeal. President Trump criticized the court’s decision, stating the need for domestic copper.

- The Bureau of Land Management declined to review the approval to halt expansion of a mining exploratory project near the San Pedro River in Arizona. The decision allows the project to move forward despite opposition from environmental groups and the San Carlos Apache Tribe, who requested the review, and cited concerns about the expansion’s proximity to the river and its potential impacts on wildlife habitat, water resources and cultural sites.

The bottom line: These decisions underscore the challenges of balancing development and environmental conservation.

Aluminum import tariffs leave scrap as a promising alternative

The U.S. 50% tariff on aluminum imports and expanded list of derivative products is pushing producers toward recycling scrap as a viable alternative to imported aluminum.

Why it matters: The U.S. aluminum industry, once a global leader, has faced declining production for the past 25 years due to international competition and rising energy costs.

The big picture: America is becoming a leading producer of secondary aluminum from scrap, a cheaper and faster solution than building a primary production facility. Aluminum-recycling plants use about 5% of the energy needed for primary production because the scrap is being melted instead of causing a chemical reaction to create aluminum from refined bauxite. However, experts say the country will have to do more recycling to meet all domestic demand or break its reliance on imported aluminum.

More aluminum news: Aluminum fell 0.15% on the LME in early September because China’s monthly production figures stayed elevated, keeping supply strong. Prices on the Shanghai Futures Exchange slightly increased in mid-August due to seasonal demand anticipation. Analysts expect supply to tighten in 2026 as China’s output is reaching its capacity and global production is expected to slow. Aluminum opened at $1.90 this morning.

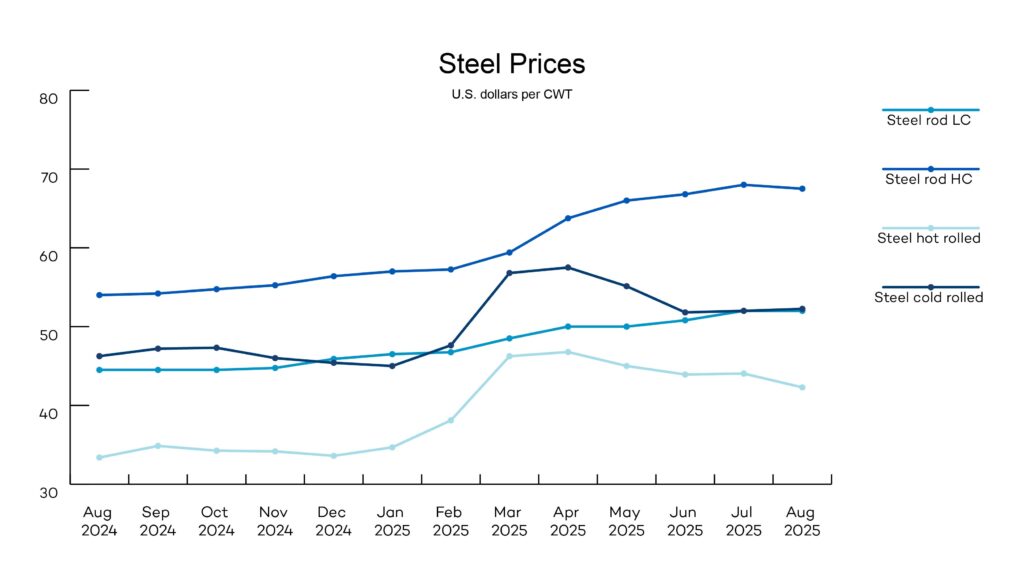

Domestic steel eyes its largest expansion but faces hurdles

The steel industry is expanding with new plants in the United States, making it the largest capacity expansion in decades despite competition from low-priced imports and soft demand from key sectors, like automotive and construction.

Why it matters: This expansion aligns with the Trump administration’s push to revitalize the industry through tariffs on imports and encourage investments aimed at bolstering national security and reducing dependency on imported steel, but the tariffs haven’t fully driven manufacturing back to the United States or created more demand for domestic steel to fully absorb the added capacity.

Between the lines: Tariffs often allow domestic producers to raise prices without losing market share on imports. Domestic steel prices have surged as much as $400 per ton, higher than in international markets. However, the boost was short-lived, underscoring that soft demand and high prices have made it difficult for domestic steelmakers to maintain profitability.

Despite the optimism of expansion, experts say the industry faces hurdles, like needing more robust GDP growth and stronger manufacturing investment, to meet the new capacity and sustain demand for domestic steel.

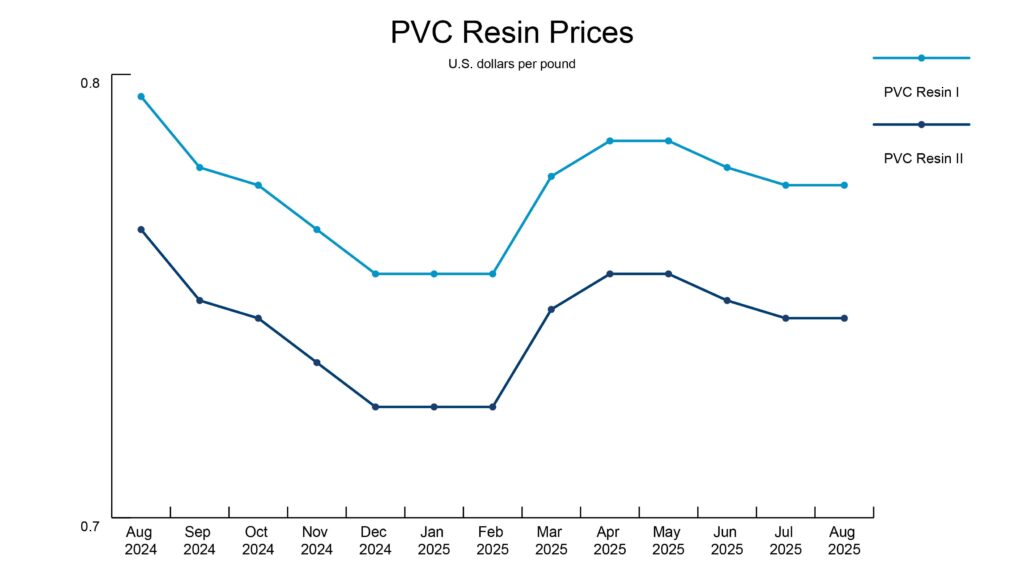

PVC manufacturers extend lead times by about one week

PVC prices continued their slight downward trend due to oversupply, weak downstream demand and slower construction activity. Rising input and logistics costs, including steel tariffs and infrastructure projects, add potential for future strain to demand outlooks.

What they’re saying: Manufacturers have extended steel and PVC lead times to about a week due to hyperscale projects consuming available capacity.

News roundup

A federal appeals court upheld a May ruling by the Court of International Trade on August 29. The appellate court found that Trump’s use of the 1977 International Emergency Economic Powers Act to impose specific tariffs did not constitute an emergency and exceeded his presidential authority. The court’s ruling will hold until Tuesday, October 14, to allow both parties to appeal to the Supreme Court, as Trump implied he would do.

The Federal Reserve (Fed) kept its benchmark interest rates steady at 4.25%–4.5% following its July meeting. But the stronger-than-expected Producer Price Index and weak job report in August create a dilemma for the Fed’s September rate-cut decision: Cut too aggressively and risk reigniting inflation or move too cautiously and risk further labor market weakness. The Fed will hold its next meeting on Tuesday, September 16, and Wednesday, September 17, allowing for market volatility to develop or settle.