Global copper supply disruption intensifies

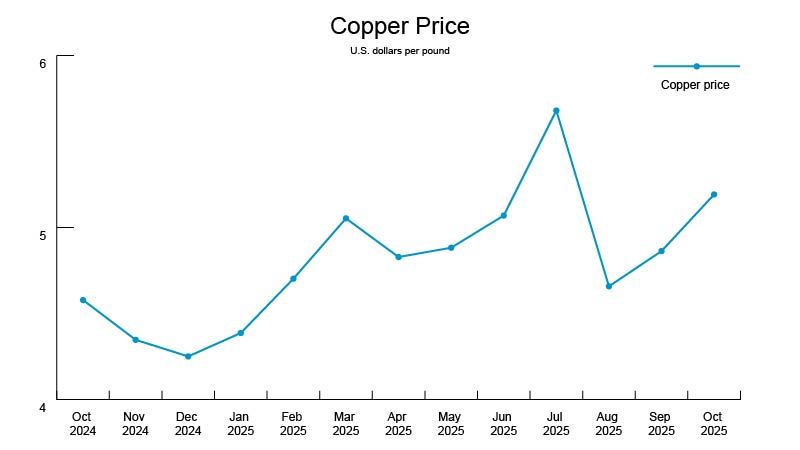

Copper prices on the London Metal Exchange reached a new high, driven by the formalized trade deal between the United States and China at the end of October.

Yes, but copper supply disruptions are intensifying, especially after a series of incidents at key mines impacted production. This signals a potential shortage next year despite a current surplus, according to the International Copper Study Group (ICSG).

By the numbers: Copper prices have surged more than 25% this year, with help from a weak U.S. dollar and falling interest rates. Even with a slowdown in demand growth, the ICSG expects production to drop by 150,000 metric tons in 2026, a complete turnaround from the 209,000-ton surplus it forecasted earlier this year through 2025 and 2026. Today, copper opened at $5.02.

More copper news: The Trump administration granted copper smelters a two-year exemption from compliance with air pollution regulations, reversing a Biden-era rule that limits emissions from stationary sources, like smelters, which the Trump administration argued would help promote domestic mineral security.

Aluminum industry calls for unified USMCA enforcement

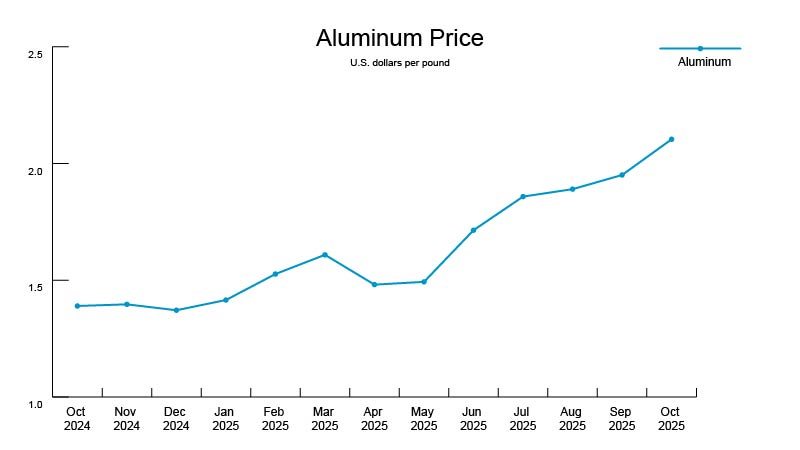

The Aluminum Association is urging the United States, Mexico and Canada to unify their aluminum tariff policies and monitor imports as the three countries prepare to review the USMCA deal in July 2026.

The big picture: The trade association wants to prevent other countries, like China, from circumventing U.S. tariffs by shipping to Canada or Mexico through methods, such as monitoring imports and enforcing policies, to ensure trilateral fair trade practices.

More aluminum news:

- Aluminum opened at $2.18 this morning. The benchmark price of aluminum has gained 14% this year.

- Aluminum prices are trading near a three-year high as smelter capacity in China struggles to keep up with rising demand. China, which produces approximately 60% of the world’s aluminum, second only to Canada, is reaching its output capacity. Pushing the country to expand smelting production abroad, which has analysts concerned about tighter supply or a greater reliance on production.

- The scrap market, particularly in the automotive sector, is facing unprecedented challenges due to outdated pricing mechanisms and insufficient data systems. As demand for aluminum in automotives continues to rise, producers are turning to advanced intelligence tools to manage alloy specifications, production disruptions and cost pressures.

Steel industry projects modest demand results in 2026

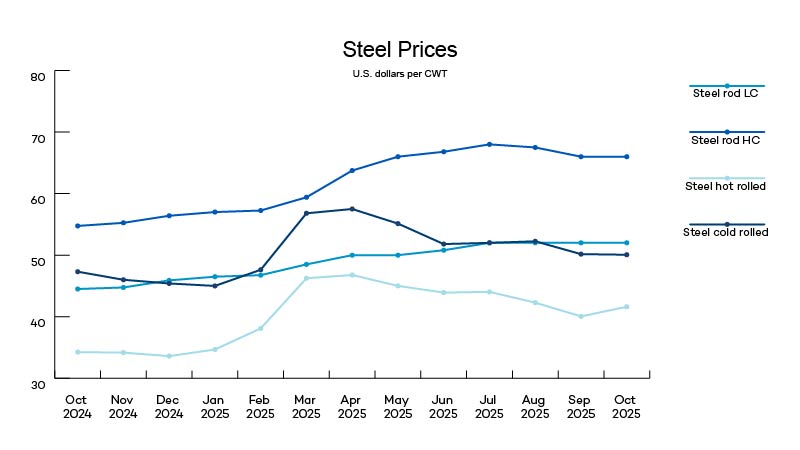

The World Steel Association projects global steel demand will remain flat for the rest of 2025 compared to 2024 and will modestly rebound in 2026.

The big picture: The association sees regional trends driving projected growth next year, including a slowdown in China’s demand decline, strong growth in India and Vietnam, and recovery in Europe.

By the numbers: The association expects steel demand in the United States to grow by 1.8%, and it expects demand in developing countries, excluding China, to grow by 3.4% in 2025 and 4.7% in 2026, with India’s demand surging by approximately 9%.

Yes, but challenges, such as elevated costs, trade tensions and geopolitical uncertainties, pose risks to this outlook, potentially dampening demand.

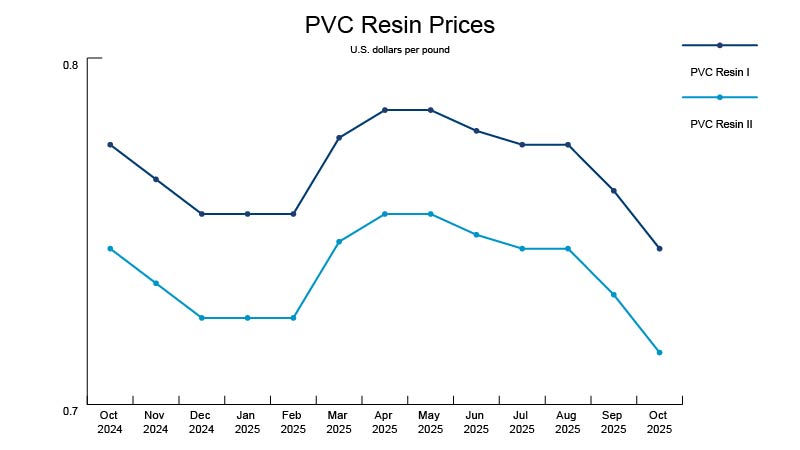

PVC prices were stable during hurricane season

PVC prices have been relatively stable during the Atlantic hurricane season, which is quietly coming to a close at the end of this month, as no hurricanes made landfall in the mainland United States.

What they’re saying: Manufacturers are reporting healthy stock levels, apart from large diameter and special radius bends, which have lead times of approximately 3–4 weeks.

News roundup

The Federal Reserve (Fed) cut interest rates by a quarter-point in October despite having official government data on job growth and the Producer Price Index. Speculation continues for another rate cut in December. The Fed will meet again on Tuesday, December 9–Wednesday, December 10.