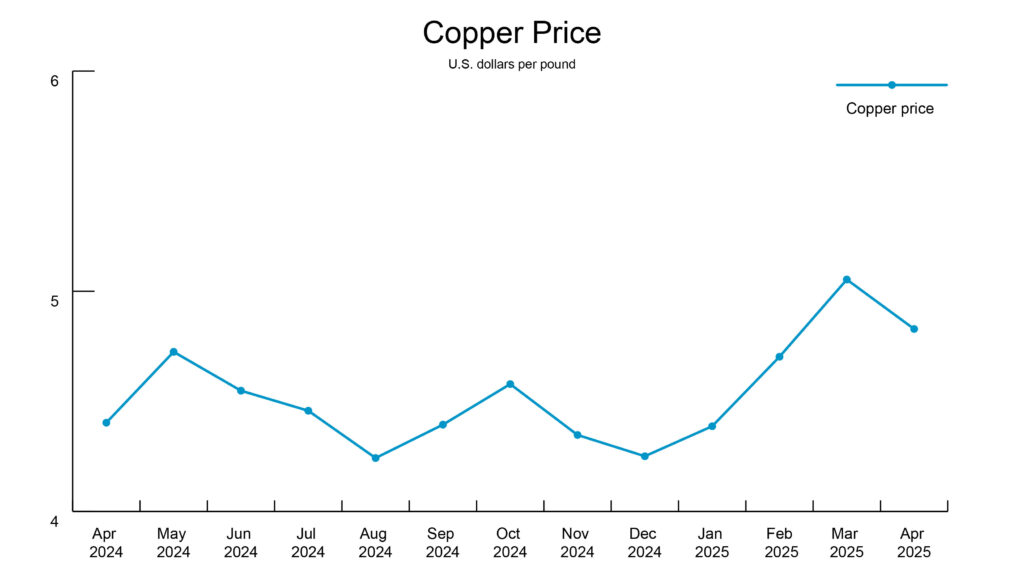

Copper prices take a stumble

At the end of April, copper prices stumbled 5.5% after data showed the U.S. economy shrank and export orders in China fell. This morning, copper opened at $4.61.

Why it matters: Often called “Dr. Copper” for its ability to indicate economic health, copper is essential across manufacturing and construction sectors. Prices are under pressure from trade tension between the U.S. and China.

The big picture: Due to the global shift to electrification, copper prices and demand are expected to remain high.

Yes, but the International Copper Study Group (ICSG) now forecasts a sizable copper surplus — nearly 500,000 metric tons — through 2025 and 2026.

- Weaker growth in China and lower-than-expected demand in Europe, Japan and the U.S. are key drivers.

- While the ICSG sees new demand from electrification technology and data centers as positives, it attributes the shift in outlook to uncertainty around U.S. trade policy, including tariffs which could slow copper usage in manufacturing and construction.

More copper news: The Trump administration added 10 additional U.S. mining projects to a fast-track permitting list aimed at expanding critical minerals production across the country.

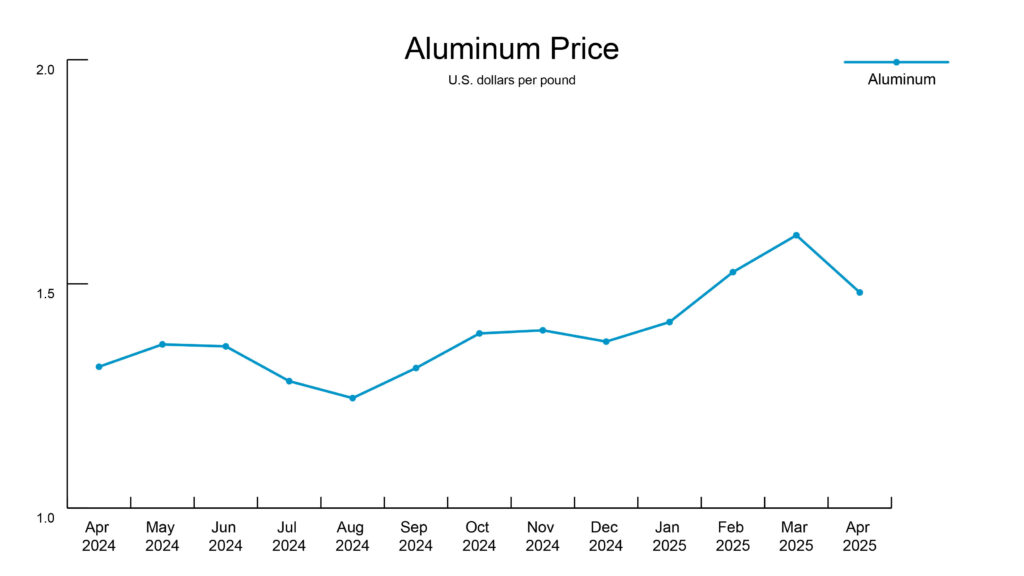

Aluminum producers face rising tariff-related costs

One aluminum producer reported about $20 million in costs from tariffs enacted in April and expects to increase costs to about $90 million in the current quarter — saying it’s “impractical” to boost domestic production capacity in the short term.

The U.S. would have to build at least five aluminum smelters to close its trade deficit. It could take up to a decade and cost billions of dollars and require additional energy production equivalent to seven nuclear reactors.

Ukraine and the U.S. signed a critical mineral deal that will grant the U.S. preferential access to Ukrainian minerals and establish a joint investment fund in Ukraine’s reconstruction. Ukraine is home to an alumina refinery which produced 1.3% of global alumina supply in 2021 before suspending operations due to the Russian invasion.

This morning, aluminum opened at $1.47.

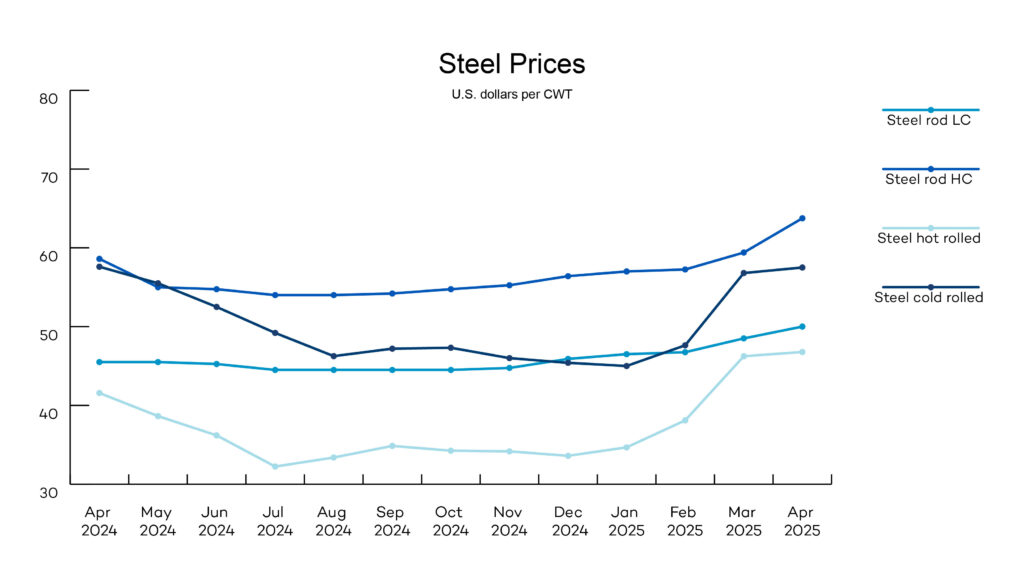

Steel demand holds strong for suppliers

Despite a wave of early purchases to avoid tariffs in March, domestic steelmakers continue to see strong demand and a high order backlog.

Why it matters: Analysts predicted that pre-tariff buying would lead to a slump later in the year, but so far, demand remains steady, suggesting robust health in the industry despite trade tensions.

The big picture: U.S. sales mirror those of foreign producer, ArcelorMittal, which saw first quarter earnings beat expectations due to higher steel prices in the U.S. that offset tariff costs. However, ArcelorMittal’s global sales were mixed, with sales down in parts of South America and slightly lower average prices in European countries, highlighting the varied impact of global trade policies.

By the numbers: U.S. producer, Nucor’s order backlog is 25% higher than the previous year with record high steel beam orders. ArcelorMittal’s North American sales rose 9.6% due to increased shipments and prices.

- Suppliers announced a 5% steel pipe increase on May 5.

- Suppliers are reporting solid stock levels and lead times of about 2–3 weeks as domestic competition heats up.

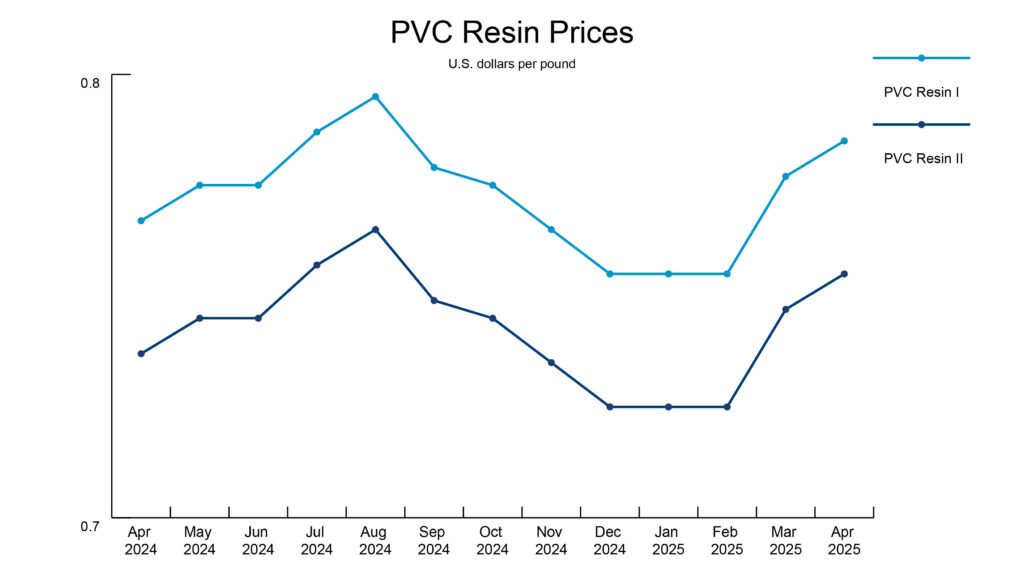

PVC market faces pressure from falling oil prices

PVC pipe suppliers report healthy stock levels aside from larger diameter pipe and special radius bends, which have a lead time of about three weeks.

U.S. crude oil prices fell to their lowest levels since 2021 after the Organization of the Petroleum Exporting Countries (OPEC) agreed to increase output by 411,000 barrels per day in June, following a similar boost in May. The two-month rise will bring over 800,000 barrels of surplus into the market, above experts’ original forecasts.

News roundup

The Federal Reserve (the Fed) held interest rates steady, keeping borrowing costs between 4.25%–4.5%. It continues to analyze the impact of U.S. trade policies, citing uncertainty surrounding the economic outlook. The Fed’s next meeting is Tuesday–Wednesday, June 17–18.

As of this morning, the U.S. and China agreed to a 90-day tariff deal. The U.S. will cut tariffs on imports from China to 30% from 145% and China will cut tariffs on imports from the U.S. to 10% from 125%.