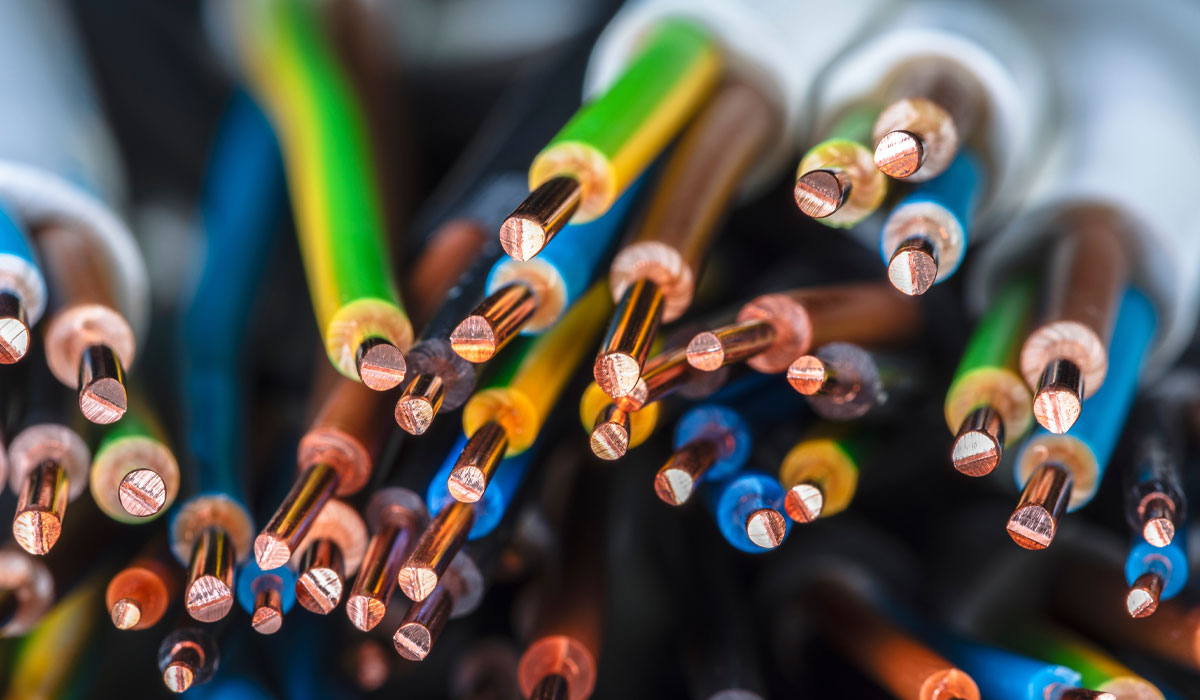

Skyrocketing copper prices leave markets reeling

Hang on for dear life — copper is climbing to levels we haven’t seen in years.

- We saw five copper wire increases from vendors in April on top of the three increases from March. A 5%-7% increase will go into effect Tuesday, May 14.

- Copper opened at $4.71 this morning, up from $4.62 on May 6.

Big picture: With a year-to-date average of $3.99, copper has already passed last year’s average of $3.86. The price of copper is now the highest it’s been since mid-2022.

Why copper is taking off: When you combine soaring demand with mining supply disruptions, you have the perfect storm for copper to spike.

- Demand from technology: Electric vehicles, renewable energy, data centers and AI are adding to demand on top of seasonal construction.

- Mining supply disruptions: Cobre Panama, a mine that produced about 1.5% of the world’s copper supply, has continued to sit idle since it was shut down in November 2023.

What’s next: The ride isn’t over yet. Bank of America raised its 2024 forecast for copper by 8%, calling out, “The copper supply crisis is here.” Citi analysts say copper is now in a bull market for the second time this century.

Aluminum prices rise to 2023 levels

The average price of aluminum rose to $1.31 in April, just one cent shy of the April 2023 average. Today, aluminum opened at $1.34.

- Vendors increased the price of aluminum wire twice in April.

- Aluminum supply is stable, but we’re seeing an uptick in demand as contractors switch to using aluminum wire for jobs.

Why it matters: Aluminum is rebounding on borrowed momentum from copper. As long as the price of copper remains high, the price of aluminum will, too.

A surplus of steel is hitting global markets

Steel suppliers again lowered prices by roughly 3% as Chinese steel surges into global markets.

- China’s real estate market slump has hurt domestic demand for steel. Instead of cutting production, Chinese steelmakers increased it and are now exporting the excess.

- Chinese steel exports increased by 84%, 78%, 58% and 55% to India, Vietnam, Turkey and Brazil respectively in the 12 months prior to February, and 33% overall, according to Chinese data.

Why it matters: On April 17, President Biden asked U.S. trade officials to triple the tariff rate on steel and aluminum imports from China. While there is no firm action yet, it’s something to be aware of in addition to Nippon Steel’s pending purchase of U.S. Steel, which the EU approved this month.

What we’re reading: Some experts argue capital-intensive technological innovation — not protectionism — is what’s needed to keep steel jobs in the U.S.

PVC suppliers aim for two price increases in May

Resin prices continue to move up but are still 38% below last year. PVC suppliers have announced a two-part increase for May.

- A 7.5% increase went into effect on May 6, and another 7.5% increase is planned for Monday, May 20.

- While the PVC market continues to stay soft overall, vendors are citing raw material costs, wage inflation, electricity costs and equipment costs.

Production remains strong, with stock lead times sitting at around four weeks.

News roundup

The Federal Reserve continues to hold rates steady in the battle to drive down inflation. The next rate meeting will take place in June.

The wars in Israel and Ukraine remain a potential concern for commodity markets as tragedy continues to unfold in those regions.