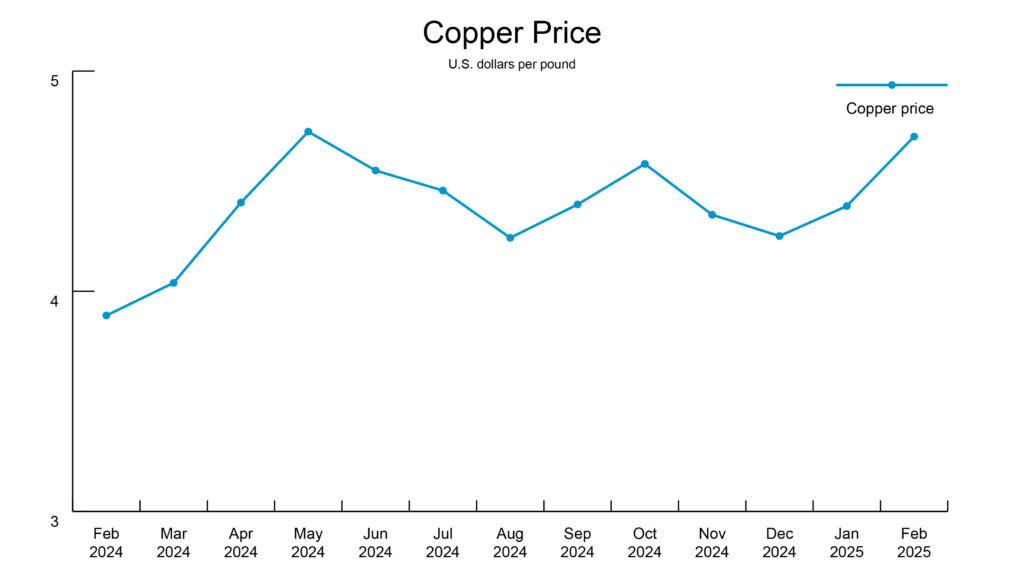

Copper comes under domestic minerals policy spotlight

President Donald Trump is making copper the focus of his domestic minerals policy with an executive order to begin an investigation into potential tariffs on copper imports.

The impact: Tariffs could significantly impact Chile, Canada, Mexico and Peru, with the investigation set to determine potential rates.

The background: The Copper Development Association officially wrote last month to President Trump to add copper to the U.S. Geological Survey (USGS) critical minerals list to secure domestic production and support long-term economic and national security needs. While the executive order calls copper a critical mineral, it is not yet included on the USGS list, despite the Department of Energy (DOE) already recognizing copper as a critical material. Legislative efforts aim to require the USGS to align its list with the DOE critical materials lists to recognize copper and other energy minerals as critical. If enacted, USGS would have to update its list within 45 days.

By the numbers: The global supply of copper in warehouses awaiting shipment is at the highest levels since 2021 due to anticipation of the U.S. tariffs.

- Suppliers increased copper wire prices by 10% on March 6. Today, copper opened at $4.67.

- Panama’s President Jose Raul Mulino visited First Quantum’s idled copper mine, fueling investor optimism for a restart, but legal, political and public opposition pose significant hurdles to reopening the $10 billion operation.

Aluminum tariffs stir the industry

The domestic aluminum industry faces turmoil as the U.S. imposed 25% tariffs on imports from Canada and Mexico on March 4 and plans to implement a 25% tariff on aluminum imports on Wednesday, March 12.

Why it matters: These tariffs are causing a spike in costs for buyers, since there are few domestic suppliers able to meet demand, while producers see it as a chance to level the playing field against cheaper imports.

What they’re saying: Industry professionals in both the U.S. and Canada argue that tariffs on aluminum could impact job security and costs, while others support the decision, highlighting the complex trade-offs of trade policy.

- The U.S. relies heavily on Canada for aluminum imports, and 90% of U.S. aluminum scraps are from Mexico and Canada due to the lack of domestic smelters capable to meet demands.

- On March 6, President Trump announced a one-month exemption from the 25% tariffs for about half of Mexican imports and 38% of Canadian imports under the U.S.-Mexico-Canada (USMCA) agreement. Canada’s energy imports will have a reduced 10% tariffs on goods that fall outside of USMCA.

- Read the Fact Sheet for a breakdown on products that use aluminum and recently active tariffs.

- Today, aluminum opened at $1.64.

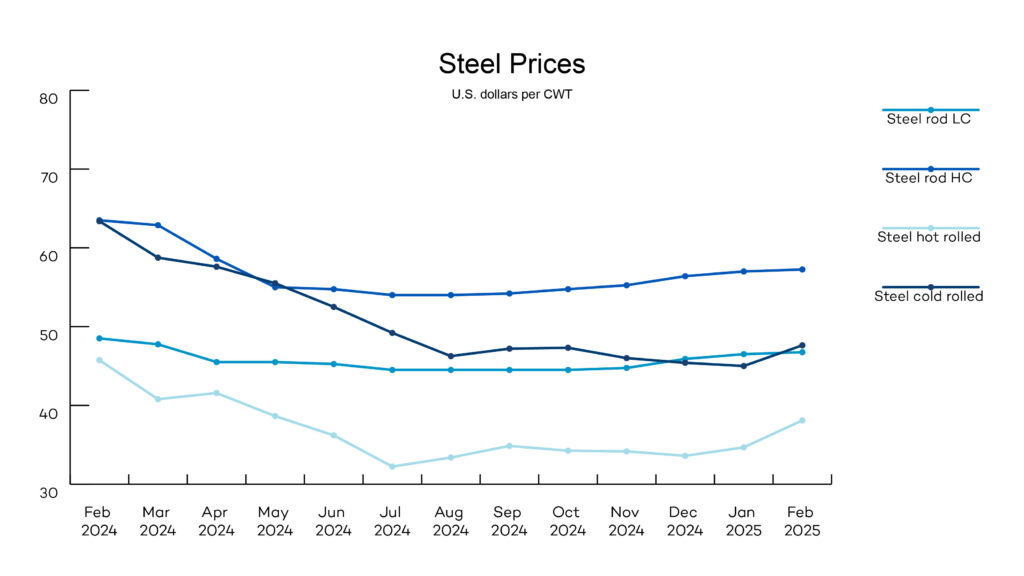

Steel tariffs spike domestic prices

Steel pipe suppliers announced a 6% price increase on March 3 in anticipation of the rollout of U.S. tariffs. More increases are expected throughout the year. Domestic production is shifting, with suppliers reporting good stock levels and lead times of about 2–3 weeks.

Anticipation of President Trump’s 25% tariff on steel imports is pushing U.S. steel prices to more than $900 per ton before the tariff takes effect on March 12.

- Steel imports have surged as international suppliers rush to deliver shipments before tariffs are implemented, even though U.S. demand is weak due to high borrowing costs and slowing construction and manufacturing activity.

- Analysts note that instead of strengthening the U.S. steel industry as intended, the tariffs have led to price increases that are already straining buyers.

Refer to the Fact Sheet for a breakdown on products that use steel and recently active tariffs.

Quick catch up: Nippon Steel plans to discuss its proposed acquisition of U.S. Steel with U.S. government officials. President Biden blocked the sale in January.

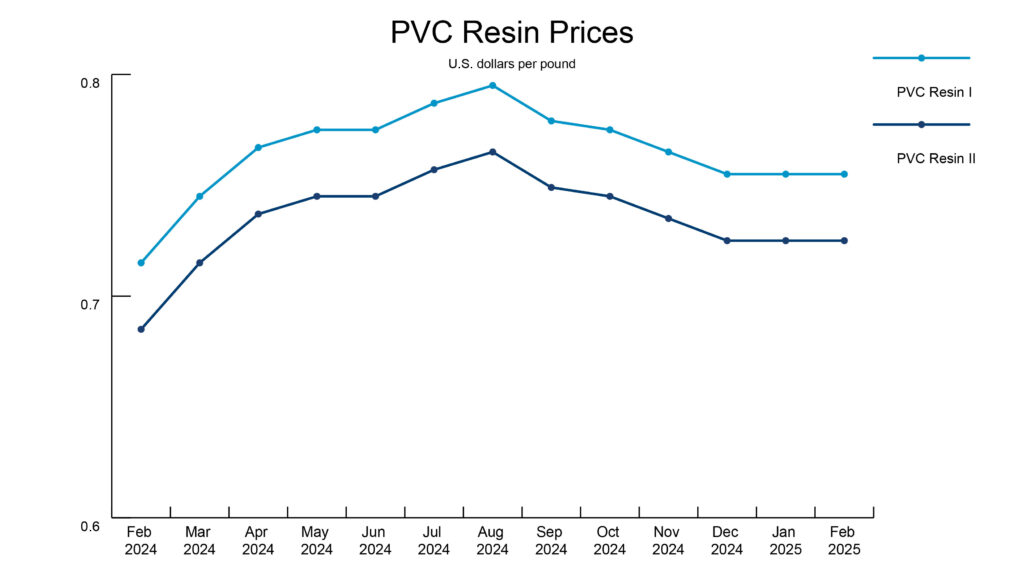

PVC prices dip despite cost pressures

Despite suppliers’ efforts to raise prices amid rising labor and transportation costs and growing demand, PVC prices are projected to fall throughout 2025.

Oil and resin costs remain stable. Storm season has had minimal impact on resin production. However, tariffs could influence oil prices in the coming months.

PVC pipe suppliers report healthy stock levels aside from larger diameter pipe and special radius bends, which have a lead time of approximately three weeks.

News roundup

The Federal Reserve (Fed) paused interest rate cuts in January amid economic policy uncertainty. The Fed’s next meeting is Tuesday–Wednesday, March 18–19.