Copper mines face global challenges

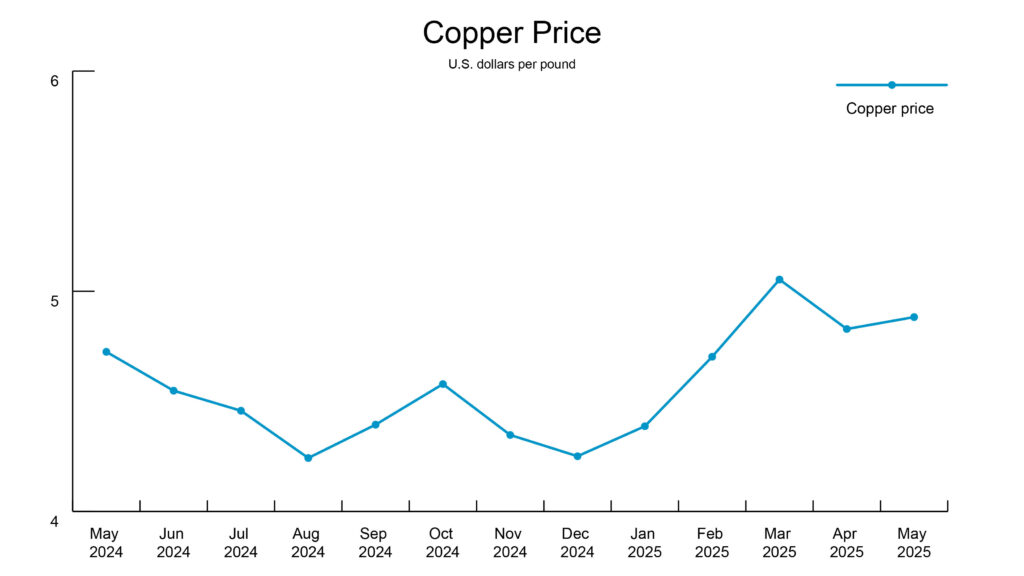

This morning, copper opened at $4.85.

Seismic activity and legal battles are impacting major copper mines worldwide.

- In the Democratic Republic of Congo, the Kamoa-Kakula copper complex, is grappling with flooding caused by seismic events, raising questions about its operational status.

- The United States Supreme Court rejected an appeal from a coalition of Apache locals in Arizona called the Apache Stronghold to block a federal land exchange for a site being developed by mining companies Rio Tinto and BHP Group. The coalition argued the mine would destroy a sacred religious site, while the companies say they’ve consulted with local tribes to reduce potential impacts.

- Panama will allow an inactive mine that closed due to anti-mining protests to export 120,000 tons of mined copper concentrate to fund the mine’s maintenance costs and avoid environmental damage. Officials stressed that the mine will not reopen.

Aluminum import tariffs double

The 50% aluminum tariff rattled the global industry, with companies’ shares falling or surging depending on their production locations.

Why it matters: The tariff hike that took effect June 4 aimed to boost U.S. metal production for national security per Section 232, further impacting global trade dynamics.

By the numbers: Alcoa, a U.S.-based company that produces mostly in Canada, faces increased costs and a 1% drop in shares, while Century Aluminum, a smaller competitor, saw shares jump about 18%.

What they’re saying: Century Aluminum supports the tariff increase as they plan the first U.S. smelter in five decades, doubling national production capacity.

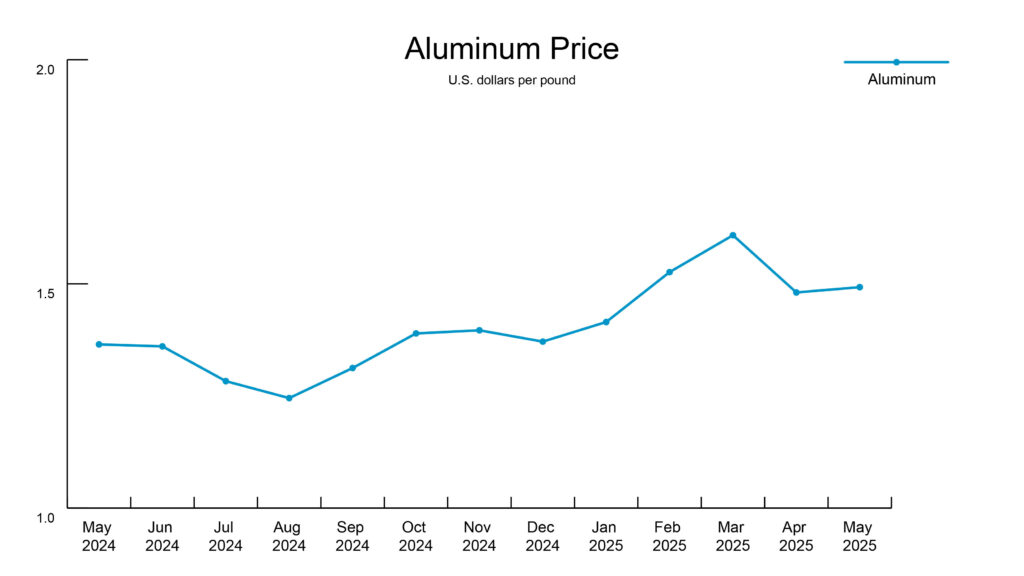

This morning, aluminum opened at $1.78.

Steelmakers plan for investment

President Trump announced tariffs for steel imports would double to 50% from 25% on June 4 during a steel rally endorsing the U.S. Steel-Nippon Steel acquisition the weekend before.

Why it matters: The move aims to bolster domestic production but faces criticism for potentially intensifying global trade disputes and impacting U.S. industries.

Steel producers plan significant investments in new production capacity in the United States.

- Nippon Steel’s approximate $14 billion purchase of U.S. Steel includes a $2.4 billion in investment to modernize steel mills in the United States.

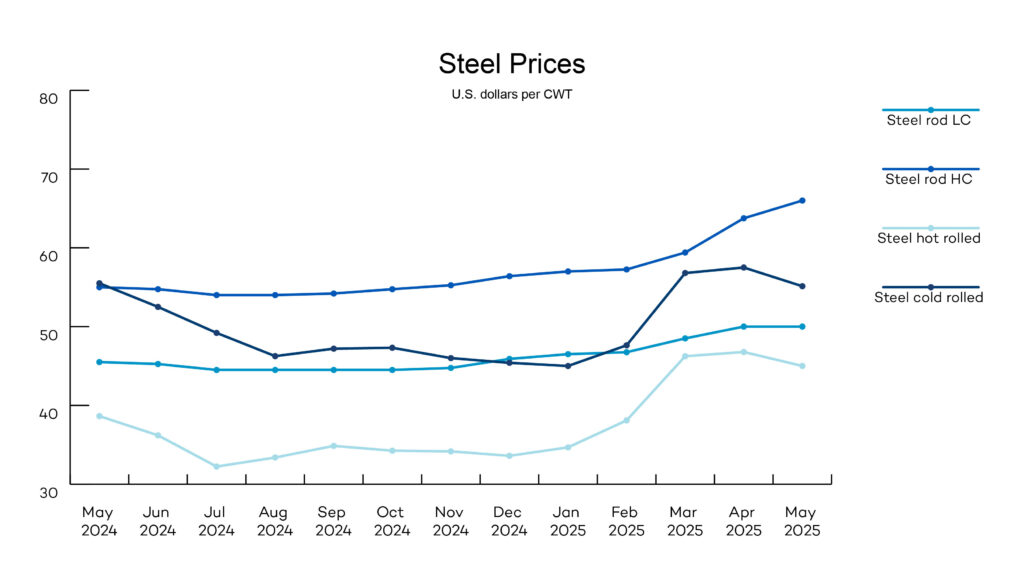

- Shares and prices for domestic steel producers have surged since the announcement.

While the tariffs are intended to encourage U.S. production and investment, experts warn of straining relations with major trade partners and increasing costs for industries reliant on these metals.

PVC prices stay down

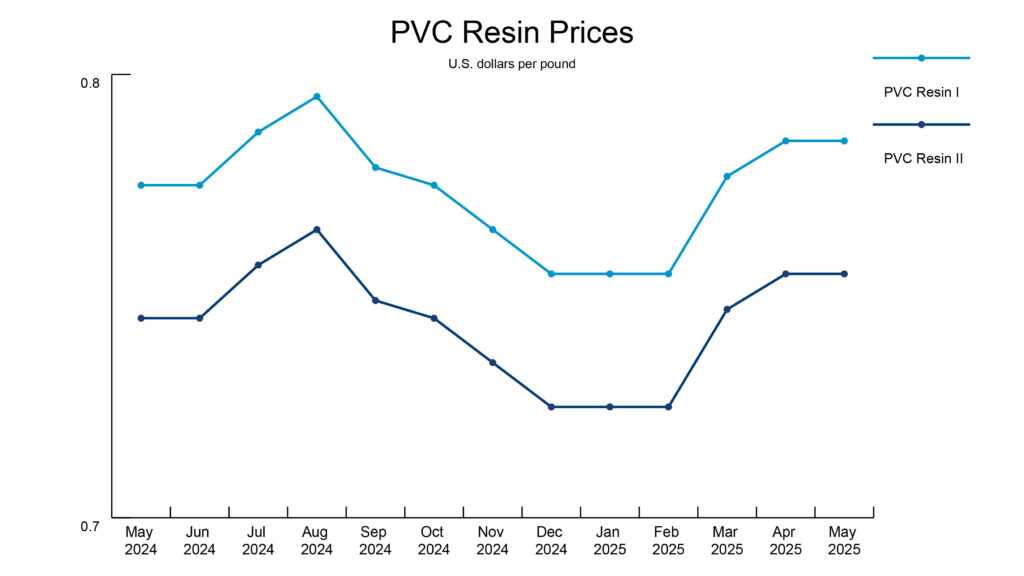

PVC prices continued on a downward trend. PVC pipe suppliers report healthy stock levels, aside from larger diameter pipe and special radius bends which have a lead time of about three weeks.

News roundup

The Federal Reserve (the Fed) still faces pressure to cut interest rates while it continue to hold rates steady. The Fed’s next meeting is Tuesday–Wednesday, June 17–18.