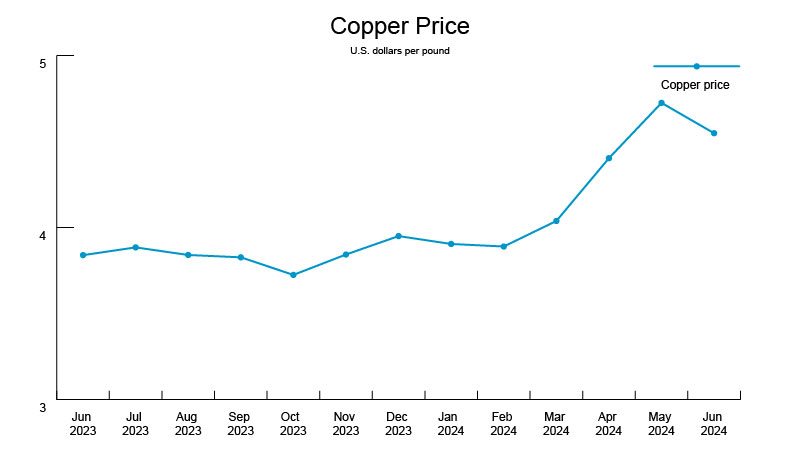

Which way next? The uncertainty of copper

The average price of copper fell from $4.78 in May to $4.52 in June.

- China’s copper inventories remain at their highest levels since 2020, which is pushing down prices.

- Copper hit a two-month low on June 27 but has ticked up slightly since then, opening at $4.65 this morning.

- Vendors announced a second copper wire increase of 5–7% for close of business on Wednesday.

Why it matters: Between the high inventory in Shanghai warehouses and the Federal Reserve’s decision to hold interest rates, the market remains confused about which way copper will go next. But as the year continues, supply will likely be the defining variable in the equation.

- If Cobre Panama mine reopens early next year, there would be a surplus of 1.8%. But if the mine doesn’t reopen, demand could exceed supply by 3%.

- Output at Chile’s Codelco mine continues to fall short of 2024 targets.

- China has increased imports of copper scrap. Scrap affects copper rates but is harder to predict than mining because it comes from recycled or finished products.

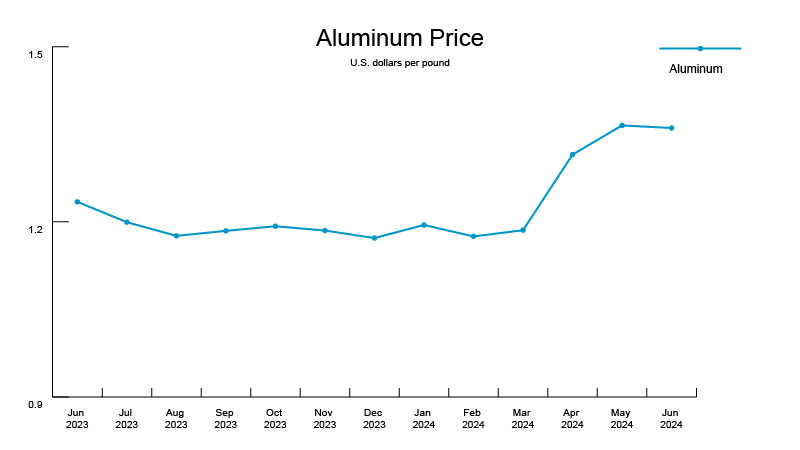

Aluminum follows copper in a downward direction

The average price of aluminum in June increased by 8% compared to the June 2023 average. Today, the price of aluminum opened at $1.33.

Aluminum lost all its May gains in June following reports of the metal being dumped into the market. The price of aluminum has fallen nearly 9% since its peak in early April.

- The Section 301 tariffs become effective Thursday, August 1. We are waiting to see how it impacts the market.

- Raw materials and finished goods are readily available from almost all vendors.

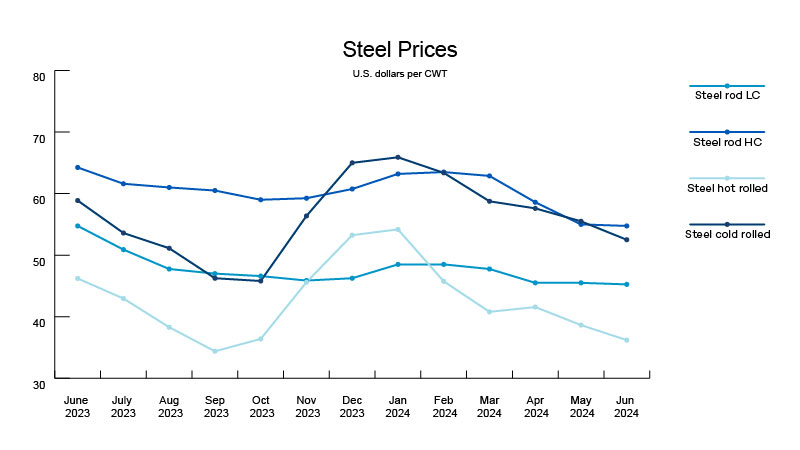

Steel suppliers navigate tariff impacts amid market shifts

Steel suppliers are trying to figure out the market ahead of 301 tariffs becoming effective next month.

What we’re watching: Florida’s governor signed a bill to support domestic steel protection, and we’re continuing to follow Nippon Steel’s bid on U.S. Steel.

More steel news:

- Lead times are mostly stable and remain at 2–3 weeks.

- The flatbed load-to-truck ratio has increased to 20 to one — the market has peaked going into the summer, particularly in the southern United States. Flatbed trailers are needed to haul 20-foot steel pipes, and trucking can cause lead-time delays and higher costs.

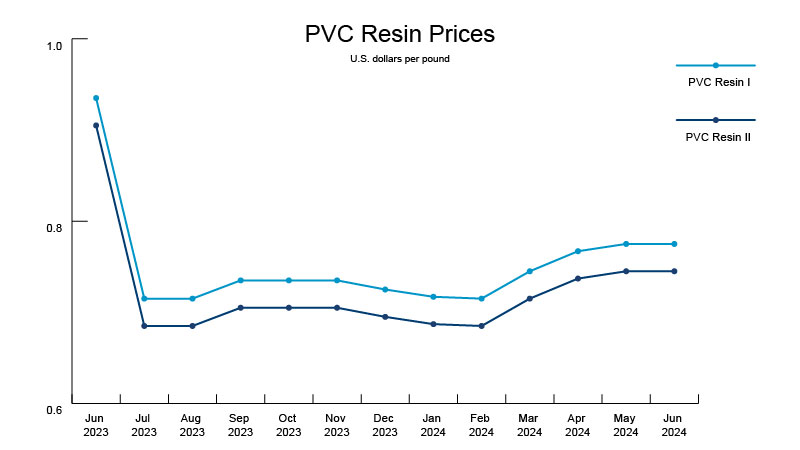

PVC prices may rise with storm season

PVC prices held steady in June. One vendor announced an increase this month as we head into storm season.

- We are watching Hurricane Beryl as it made landfall in Texas as a Category 1 hurricane. A hurricane warning remains in effect along the coast of Texas.

- The National Oceanic and Atmospheric Administration predicted an 85% chance of an above-normal season.

Why it matters: PVC manufacturers are primarily located in the Gulf region. Storms can impact pricing and lead times on PVC. Vendors estimate at least 15-days’ supply of finished goods due to storm season, but this will likely increase in the coming months.

More PVC news:

- Production remains strong with good inventories available and lead times of stock at four weeks.

- The market overall continues to stay soft as demand has declined and distributors have healthy inventory levels.

News roundup

The Federal Reserve continues to hold rates steady in the battle to drive down inflation. The Federal Open Market Committee’s next meeting is Tuesday–Wednesday, July 30–31.