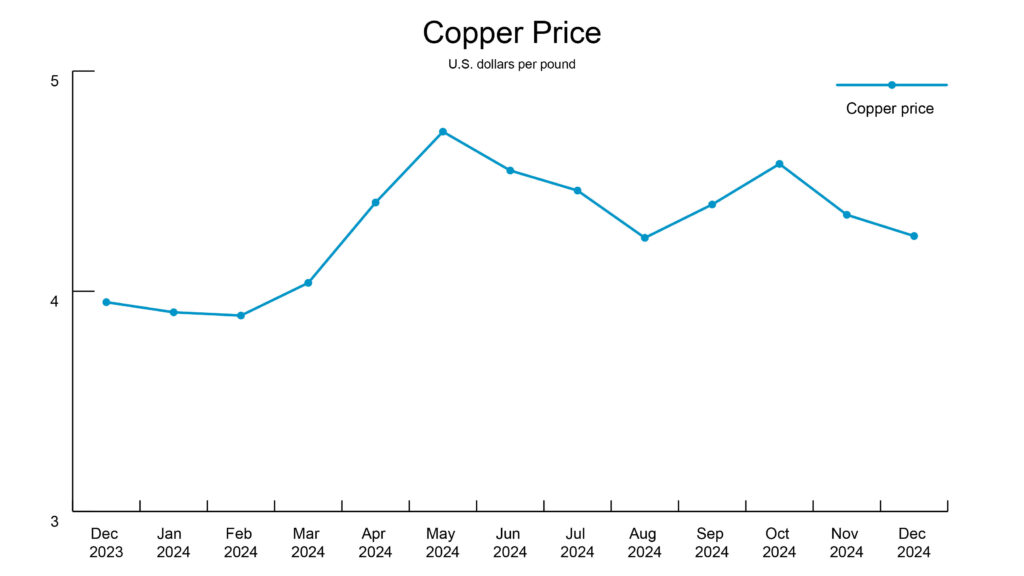

Copper prices fluctuate to start the new year

Today, copper opened at $4.29, up from the second-highest year-to-date average of $4.24 on record. Earlier this month, suppliers raised copper wire prices twice, citing a weaker dollar.

- A weaker dollar and the Federal Reserve (Fed) interest rate cut by one-quarter percentage point in December 2024 strengthen the metal’s value.

- Raw copper prices continue to rise due to growing demand for renewable energy technologies and disruptions in copper supply.

Yes, but: Copper prices steadied near a nine-month low as the new year began, with the global metals market focusing on China’s plan to stimulate its economy. Prices briefly rose then dropped in the Chinese stock market after a weaker-than-expected manufacturing activity report raised doubts on the strength of China’s recovery plan.

Why this matters: Copper’s future hinges on China’s economic recovery and potential stimulus impacts. The metals market is closely watching for signs of increased demand from China’s recovery plan. Additionally, potential tariffs from the incoming U.S. administration could prompt larger stimulus measures in China, further influencing copper prices.

More copper news: A top miner in Indonesia is in discussions with the government to continue copper concentrate exports until its new smelter, which was shut down by a fire in October 2024, returns to full operation.

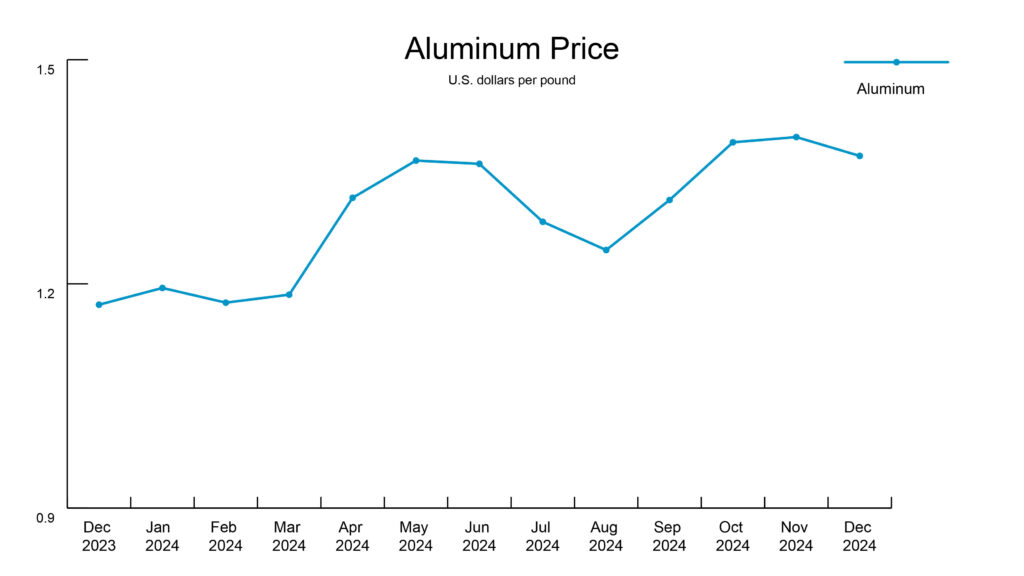

Aluminum premiums spike in Japan

Today, aluminum opened at $1.38, slightly higher than the 2024 year-to-date average of $1.29.

Some aluminum buyers in Japan have settled on a 30% premium increase for aluminum shipments in the first quarter of the new year. Driven by regional supply concerns, this is the highest increase the region has seen in nearly 10 years.

Why this matters: Japan is a major aluminum importer, and the premiums it agrees to pay set a benchmark for the region. These negotiations follow China’s cancellation of a 13% export tax refund for aluminum semi-manufactured products, which is expected to boost demand for primary aluminum ingots in Asia. Global production cutbacks due to high alumina prices and civil unrest in other aluminum-producing nations are further constraining global supply.

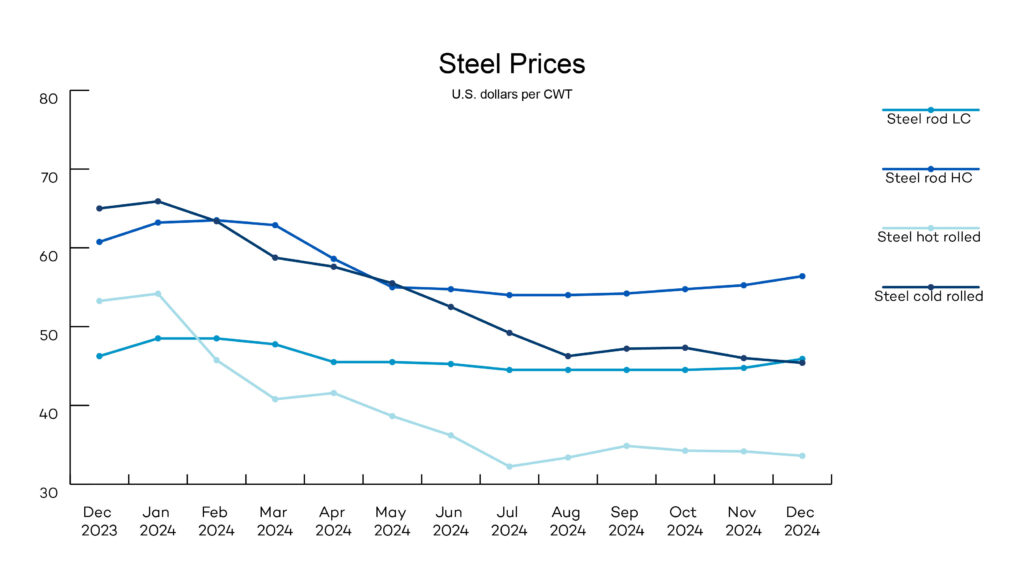

Steel pipe prices are on the rise

Steel pipe manufacturers have announced an increase of 6%–8% to kick off the new year, citing rising raw material costs for producing steel pipe.

Why it matters: The steel industry faces uncertainty with maintenance season underway, the upcoming transition of administrations, potential tariffs and the recent intervention by President Biden to block the purchase of U.S. Steel by Nippon Steel.

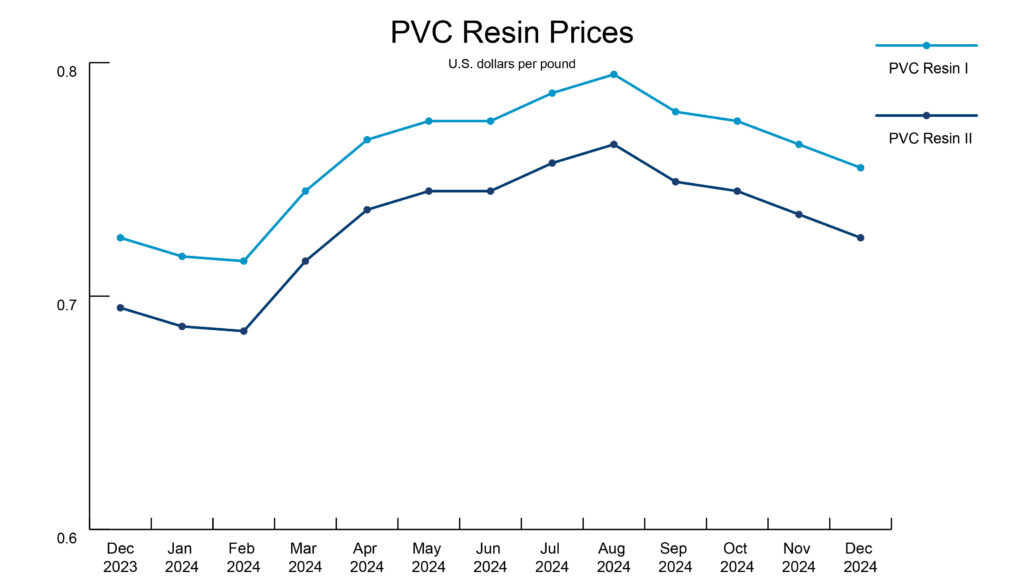

PVC pipe sees strong demand to close out 2024

PVC pipe suppliers experienced strong demand patterns in December 2024, with scheduled maintenance causing a one-week delay in lead times.

Suppliers expect to recover from the one-week delay and plan to begin building inventories in preparation for a strong spring construction season.

News roundup

The Fed cut interest rates by one-quarter point in the middle of December 2024, with speculation that there would be fewer cuts throughout 2025. The Open Market Committee’s next meeting is Tuesday–Wednesday, January 28–29.

Border States is introducing a newsletter, the Supply Chain Update, in January to help you navigate the challenges of the global supply chain. Sign up to get the monthly updates in your inbox starting next week.