Copper miners and smelters negotiate fees for next year

The copper world is keeping an eye on the ongoing annual processing fee negotiations between global miners and China’s smelters, which have the largest capacity in the world. These annual negotiations set the benchmark for global copper prices and provide miners with stable, long-term supply deals.

The big picture: This year’s talks are intensified by a shortage of copper ore following a series of mine incidents that impacted global production and overcapacity in China, which has led smelters to receive record-low fees to process raw materials.

Why it matters: Miners usually pay smelters to process ore into finished metal, but due to tight supply and overcapacity, Chinese smelters are concerned about processing fees that could be zero or negative, meaning they would have to pay to receive raw materials. These low fees have affected copper smelters worldwide, forcing some to cut production to offset them and address overcapacity.

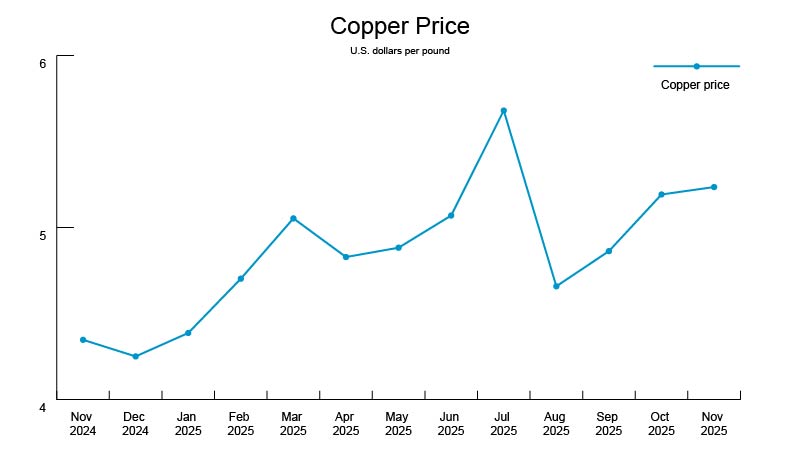

By the numbers: Smelters around the world are operating at a combined 75% capacity, a record low efficiency rate. However, copper futures on the London Metal Exchange reached a record high in late October, fueled by tight supply, a weaker U.S. dollar, a weaker production forecast and the U.S.-China trade agreement. Today, copper opened at $5.38.

U.S. aluminum industry struggles with high energy costs

Demand for data centers and hyperscale projects is also driving strong demand for aluminum, pushing prices higher even as producers face increased energy costs and global competition.

Why it matters: Aluminum plays a critical role in cooling systems and other data center components. Demand is expected to nearly triple by 2030, but producing the metal requires a vast amount of energy.

The big picture: U.S. smelters, like Alcoa and Century Aluminum, have seen stock prices recover but are under pressure from high electricity prices and competition with giant tech companies for power.

The bottom line: Experts say that for the U.S. aluminum industry to be sustainable and competitive, there must be immediate investment, and governments must improve the regulatory permitting process for energy and manufacturing projects to mitigate energy costs and reduce reliance on imports.

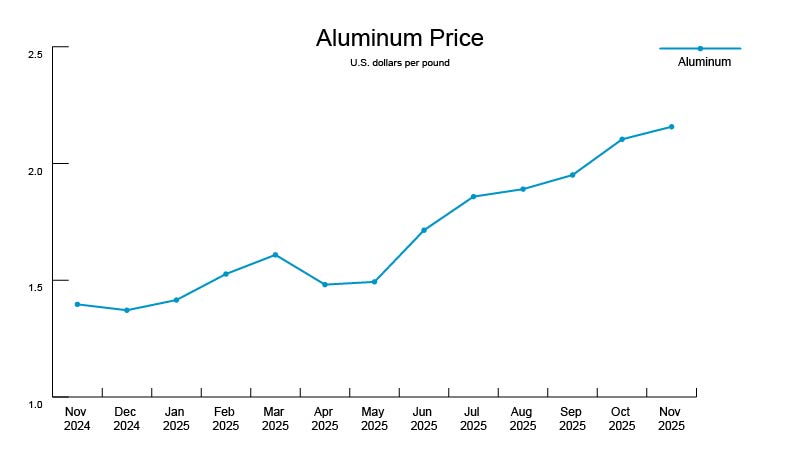

By the numbers: Aluminum prices have increased approximately 55% year to date. Today, aluminum opened at $2.19.

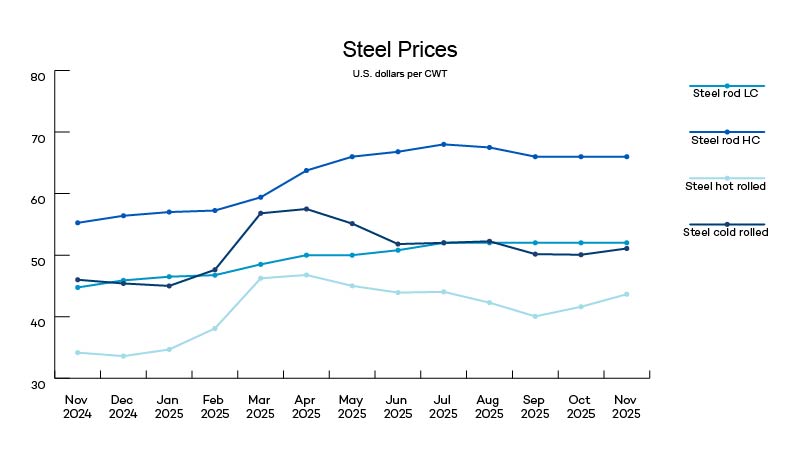

Steelmakers announce job cuts as trade tensions escalate

Germany’s largest steelmaker, Thyssenkrupp, announced an agreement with a labor union to cut or outsource about 40% of its workforce and reduce production capacity. Canada’s Algoma Steel will also cut its workforce by about one-third beginning next year.

Why it matters: Both steelmakers have cited unfair international competition practices and escalating trade tensions affecting their production as key reasons for layoffs, highlighting the significant challenges the industry faces globally.

More steel news:

- European Union (EU) and United States officials met in late November to revisit details of their July trade agreement. The United States wants the EU to change its digital technology rules; in exchange, it would reduce its tariffs on steel and aluminum imports. The two sides reached a trade agreement in July, in which the United States set a reduced 15% tariff on most goods from the bloc but kept a 50% tariff on aluminum and steel.

- Canada will impose a 25% tariff on a list of steel-derived imports, starting Friday, December 26, to protect its industry from cheap imports and international trade tensions. About 40% of products on the list are from the United States. Canada’s 25% counter-tariff on steel and aluminum products from the United States remains in effect.

PVC suppliers push for price hikes due to demand

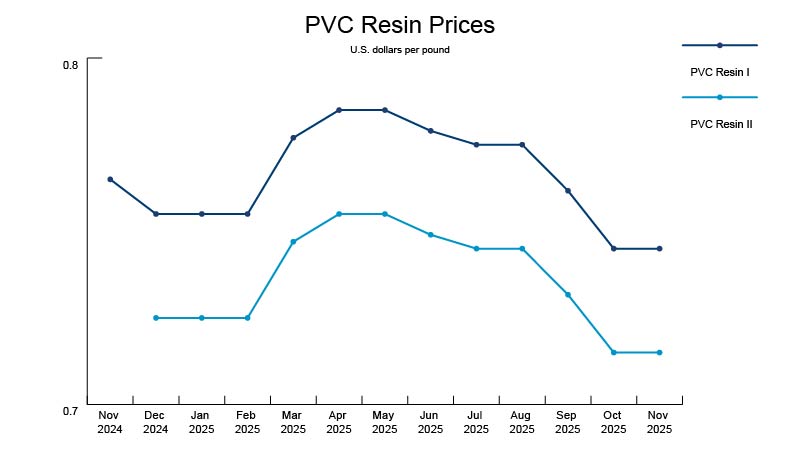

PVC prices continue their slight downward trend. Some suppliers have attempted to push though price increases, citing demand, labor and transportation costs. Experts say if demand continues to outpace supply, more manufacturers could support a market increase.

More PVC news: Due to hyperscale projects, lead times for large-diameter PVC increased by 4–5 weeks.

News roundup

The Federal Reserve (Fed) cut interest rates by a quarter-point in October despite having official government data on job growth and the Producer Price Index. Speculation continues over another rate cut in December, but the minutes from October’s meeting show officials are divided on whether another rate cut is necessary by the end of the year. The Fed will meet again Tuesday, December 9–Wednesday, December 10.