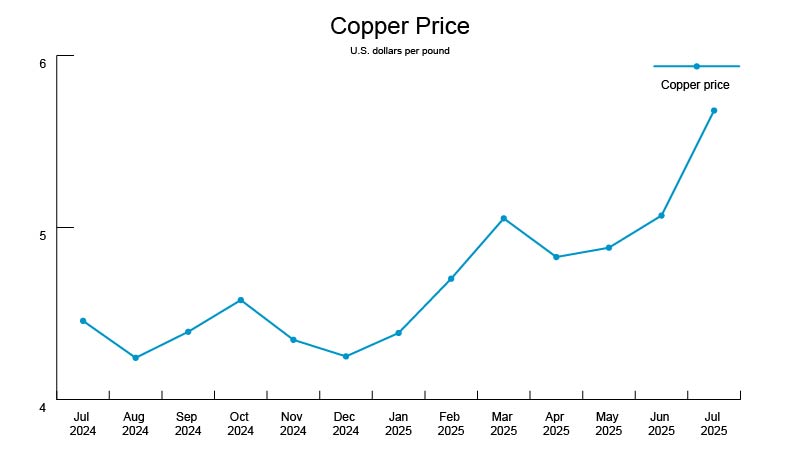

Copper tariff twist shocks markets

The unexpected exemptions in President Trump’s 50% tariff on certain copper imports have led to a drop in domestic copper prices, surprising traders.

Zoom in: Trump’s July 30 executive order excludes copper materials like ores, concentrates, mattes, cathodes, anodes and copper scrap. Only semi-finished and derivative imports, including pipes, wires, rods, sheets, tubes, pipe fittings, cables, connectors and electrical components, are affected.

The big picture: Trump ordered a probe into copper imports in February and then announced plans for a sweeping 50% copper tariff in early July. The market interpreted this as applying to all copper imports, prompting a surge in copper shipments into the United States and causing COMEX-traded copper to spike far above the London Metal Exchange (LME) benchmark.

Dive in: There are three main exchanges that store copper and influence global and regional copper prices.

- LME sets the global benchmark price based on the inventory levels of its warehouses, which are primarily in Europe and Asia.

- COMEX influences copper prices in North America, with warehouses mainly in the United States.

- Shanghai Futures Exchange (SHFE) operates within China, and its pricing reflects China’s internal copper supply and demand.

Why this matters: Globally, warehouse inventories are almost flat compared to last year. However, arbitrage trading — buying cheaper copper on the LME and selling it on COMEX at a premium — pushed COMEX inventories to their highest levels in over two decades while LME inventories dropped about 50% year-to-date. Arbitrage trading has flourished in recent months in anticipation of tariffs.

When news about the exclusion broke,

- COMEX futures fell 22%, the largest recorded one-day drop, and reduced the premium over LME to $27 a ton.

- The practice of arbitrage trade collapsed.

What they’re saying: Analysts expect a short-term shift in premiums and a return to global fundamentals like China’s demand and ongoing supply constraints.

This morning, copper opened at $4.46.

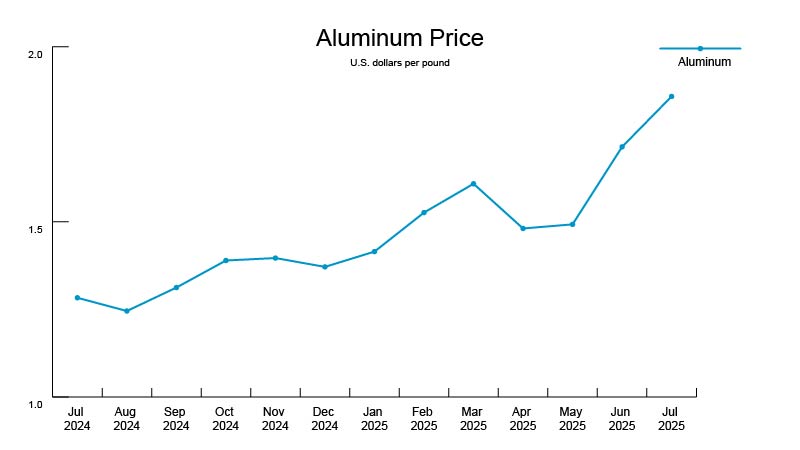

Aluminum Midwest Premium soars to record high after tariffs

The U.S. Midwest Premium (MWP) hit record highs last month after the 50% tariff went into effect.

Between the lines: The MWP is the regional price of aluminum in the American Midwest, an additional cost added to the base LME aluminum price for deliveries to the Midwest and an indicator for domestic demand.

By the numbers: The MWP soared to 68.25 cents per pound, a record high on July 18, highlighting the market conditions and impacts.

- Other global premiums in Europe and Japan experienced declines within the same period due to U.S. tariffs, causing overstock in supply and weak demand.

- Analysts say that high premiums could suppress demand in the automotive and construction sectors.

- Aluminum opened at $1.90 today.

In other aluminum news: Smelters in Canada have started to divert aluminum shipments away from the United States following the 50% aluminum tariff. Aluminum imports dropped sharply before the U.S. tariff took effect in April and May. Aluminum scrap that is subject to lower reciprocal tariff rates has been filling in some of the gaps left over.

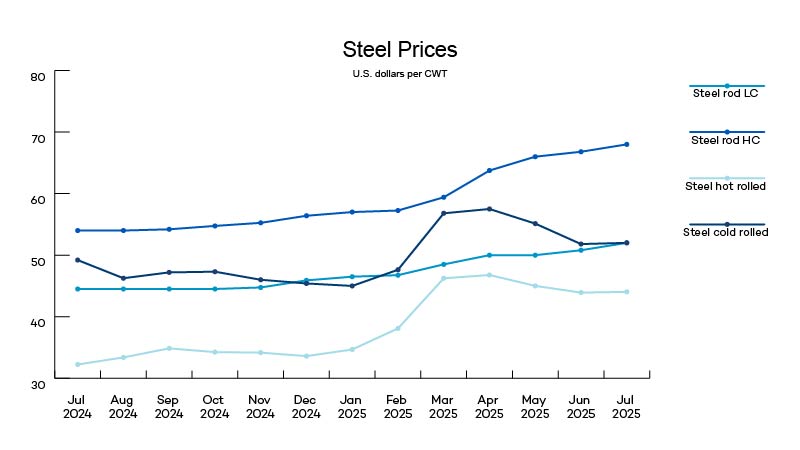

Canada ramps up its steel defenses to protect producers

Canada introduced a few trade measures to protect its steel industry against U.S. tariffs and global overproduction in countries with which it has a free trade agreement, excluding the United States and Mexico.

- A 50% tariff on steel imports exceeding 2024 levels.

- An additional 25% tariff on all imports containing steel that was melted and poured in China.

Why it matters: Prime Minister Mark Carney said these measures shield Canadian steel producers from unfair competition and trade diversion, ensuring the industry’s competitiveness in a challenging global market.

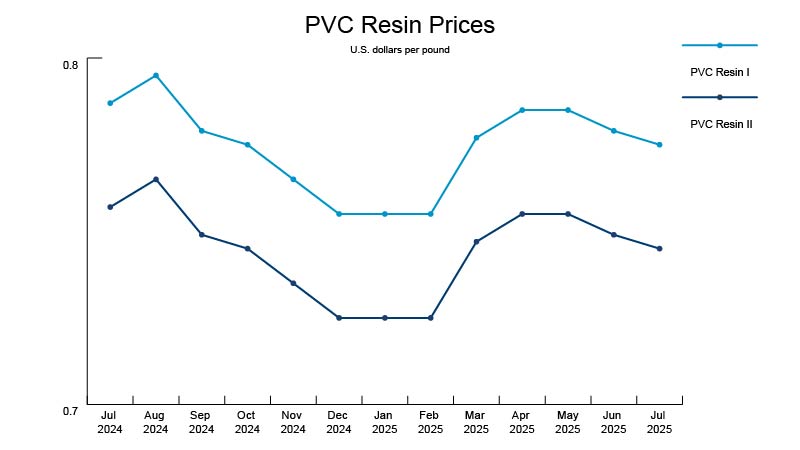

PVC prices stay down with strong inventory

PVC prices continued a downward trend. PVC manufacturers report strong inventory, aside from larger diameter pipes and special radius bends, which have a lead time of about three weeks.

News roundup

A tragic explosion was reported today at a U.S. Steel coking plant near Pittsburgh. Our hearts are with those impacted.

President Trump said he will impose a 100% tariff on semiconductor imports, excluding companies that manufacture or commit to manufacturing in the United States.

President Trump issued an additional 25% tariff on goods from India, effective Wednesday, August 27, bringing the total to 50% due to India’s purchases of Russian oil.

The Federal Reserve (Fed) kept its benchmark interest rates steady at 4.25–4.50% following its July meeting. Fed Chair Jerome Powell said the sole focus is on keeping inflation under control, noting that it’s too soon to assess the full impact of the recent tariff changes made by the Trump administration. Powell expects the release of more economic data before the next Fed meeting on Tuesday, September 16 and Wednesday, September 17. He signaled a continued “wait-and-see” approach, suggesting a rate cut in September is uncertain.