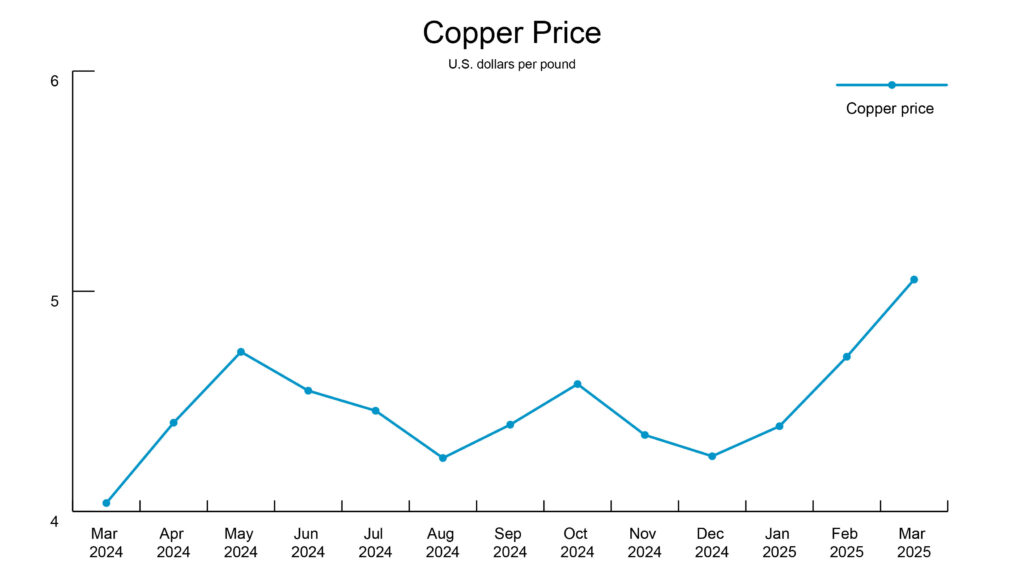

Copper prices plunge after counter-tariff announcements

Copper wire prices surged throughout the first quarter of 2025, with 11 price increases. In early April, the metal fell nearly 60 cents per pound.

The big picture: Prices were on a high as suppliers rushed to move the metal into the U.S. after President Trump ordered an investigation into potential tariffs on copper imports. In response, China increased tariffs on U.S. goods to 125% that took effect on April 12.

- Copper prices dropped sharply on major exchanges. On the London Metal Exchange, prices fell below $9,000 a ton, making it the biggest weekly drop since March 2020.

- Copper contracts fell below $4.30 per pound, following a 14.1% decline the previous week. As of this morning, copper opened at $4.58.

On April 9, President Trump authorized a 90-day pause on all reciprocal tariffs except those on China, bringing tariffs on goods from China to at least 145%. China responded with an increased 84% tariff on U.S. goods that took effect on April 10.

Copper imports were exempt from reciprocal tariffs, but uncertainty lingers: is this a market reset, or where will the bottom be?

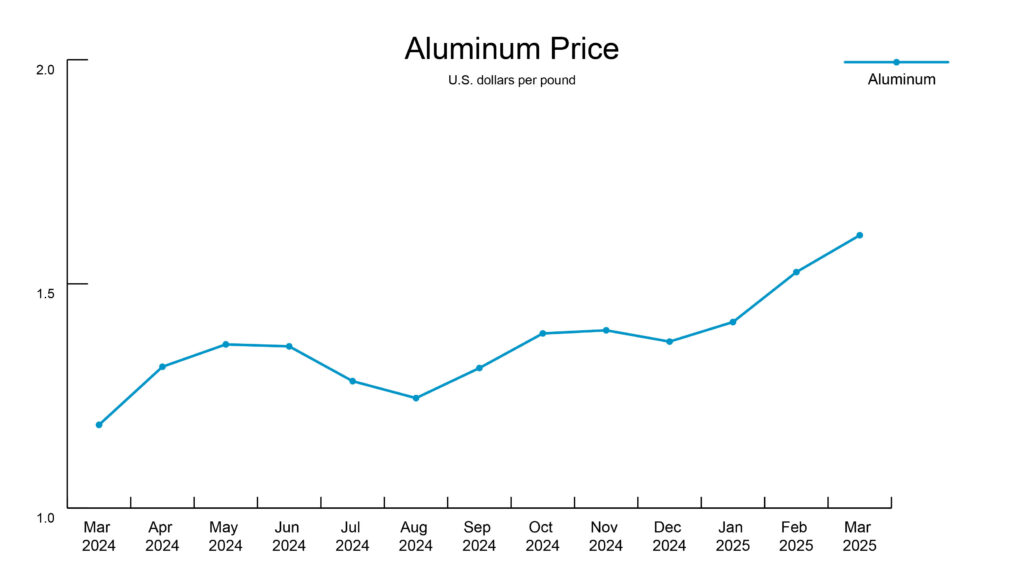

Aluminum imports spared from additional tariffs

Aluminum wire prices rose three times in the first quarter of 2025. This morning, aluminum opened at $1.45.

Aluminum imports were exempted from U.S. reciprocal tariffs since they were already subject to a 25% tariff implemented in March. Prices are hovering around $1.45–$1.60.

Background: On March 6, President Trump announced a one-month exemption from the 25% tariffs for about half of Mexican imports and 38% of Canadian imports under the U.S.-Mexico-Canada Agreement (USMCA).

- Canada’s energy resources, which include critical minerals like aluminum, will receive a reduced 10% tariff on goods if they don’t meet USMCA requirements.

- In 2024, the U.S. imported more than half of its aluminum use from Canada, valuing it at about $11.49 billion. Trade experts say U.S. manufacturers who depend on Canadian metals will face substantially high prices due to tariffs and may have trouble finding alternate materials not covered under tariffs.

- The domestic aluminum industry supports exemptions for Canada since the limited U.S.-based smelters are at full capacity and cannot keep up with demand.

Read the Fact Sheet for a breakdown of products that use aluminum and recently active tariffs.

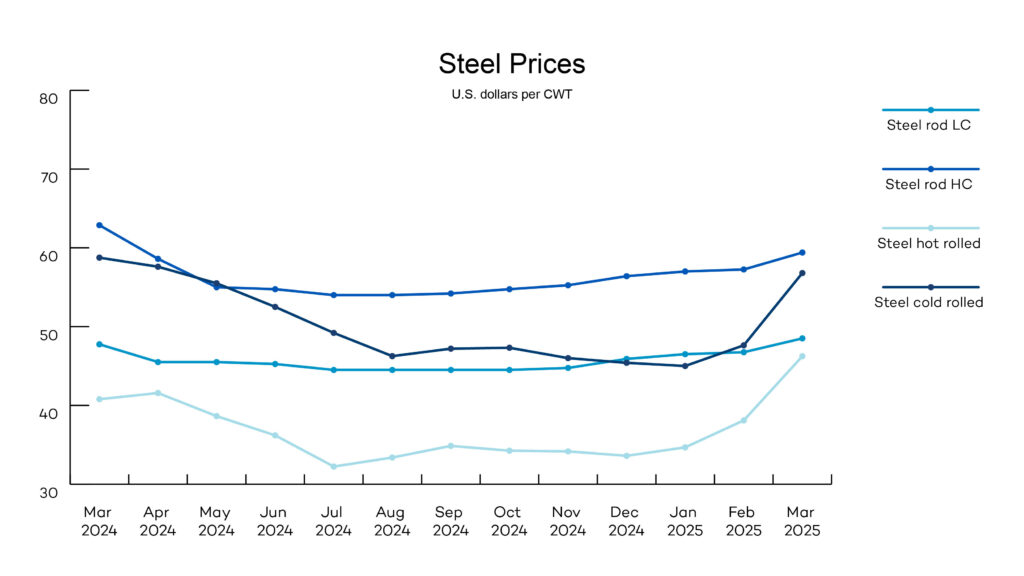

Steel manufacturers on the hunt for supplies

Steel pipe suppliers are reporting solid stock levels and lead times of about 2–3 weeks, as domestic competition heats up. In the first quarter of 2025, there were five price increases for steel pipe.

Tariffs on steel and aluminum imports have domestic manufacturers scrambling to source materials for even the smallest components, like screws and nails, which are essential across industries including construction, automotive and home appliances.

Why it matters: About $178 billion of imported steel and aluminum products from last year are now subject to 25% tariffs. With limited domestic production capacity for key components, manufacturers are struggling to meet demand.

Refer to the Fact Sheet for a breakdown of products that use steel and recently active tariffs.

More steel news:

- The European Union (EU) delayed its first set of counter-tariffs on U.S. goods to pursue negotiations instead after President Trump issued a 90-day pause on reciprocal tariffs. The EU is also reducing steel imports to the U.S. by 15%.

- Nippon Steel was granted an extension to continue government negotiations. President Trump directed the U.S. national security panel to review Nippon Steel’s bid to determine if further action is appropriate.

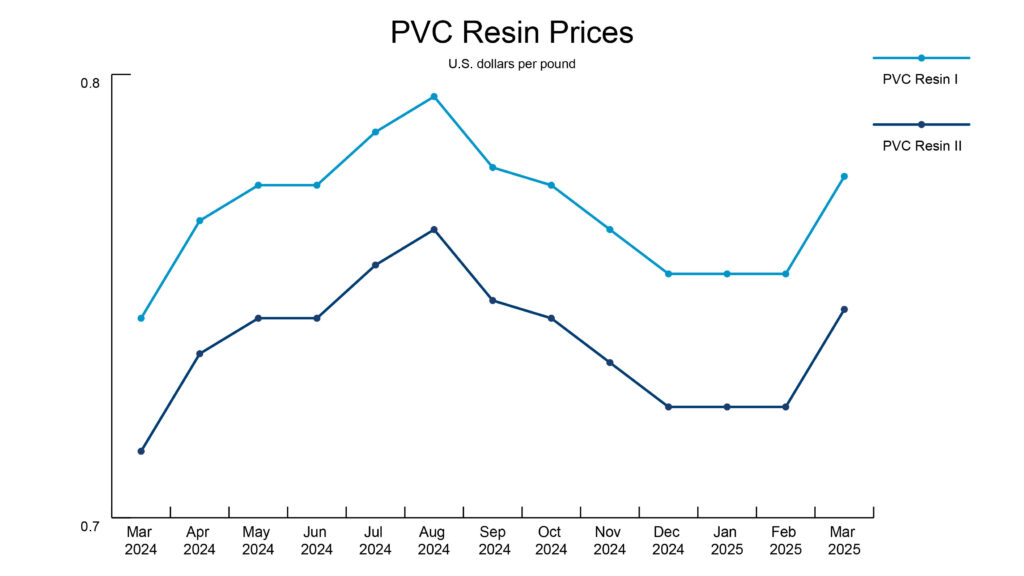

PVC market holds its breath on oil prices

Despite suppliers’ efforts to raise prices amid rising labor and transportation costs and growing demand, PVC prices are projected to fall throughout 2025.

Oil prices are trending downward, it remains to be seen how the PVC market will react.

PVC pipe suppliers report healthy stock levels aside from larger diameter pipe and special radius bends, which have a lead time of about three weeks.

News roundup

The Federal Reserve (Fed) paused interest rate cuts with the new administration’s roll out of a slew of policy changes. Fed Chair Jerome Powell is referring to this time as a “wait and see” period due to elevated uncertainty. The Fed’s next meeting is Tuesday–Wednesday, May 6–7.