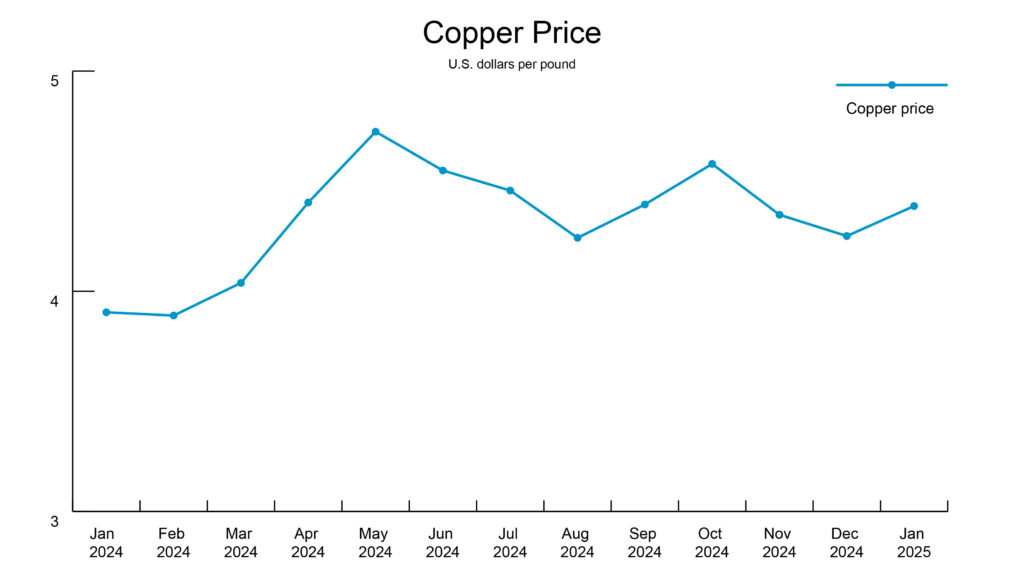

Copper industry pushes for critical mineral status

The Copper Development Association officially wrote to President Trump to add copper to the U.S. Geological Survey (USGS) critical minerals list due to its essential role in national security, infrastructure and emerging technologies, like AI and renewable energy.

Why this matters: The USGS published a final list of 50 mineral commodities in 2022 and is expected to publish a mineral commodity report this year. Adding copper to the list could help secure domestic production and support long-term economic and national security needs.

China announced limited tariffs targeting energy and machinery imports in response to President Trump’s 10% tariffs on imports from China that took effect February 4.

- China’s counter tariffs took effect February 10.

- A 10% tariff on energy resources from Canada and 25% tariff imports from Mexico and Canada were delayed for 30 days after the two countries negotiated with President Trump.

- Copper wire suppliers announced a price increase effective today. This morning, copper opened at $4.65.

More copper news: The Democratic Republic of Congo and Zambia, Africa’s top copper producers, are working on deals to secure a share of their mined copper for trading, aiming to benefit from rising demand from AI and green energy sectors.

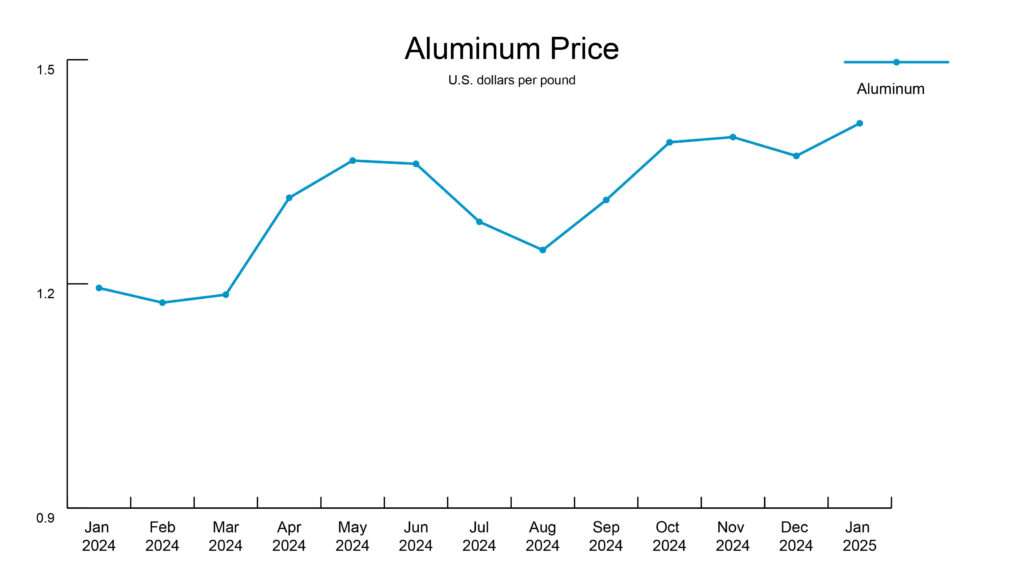

Aluminum industry seeks tariff exemptions

Today, aluminum opened at $1.47.

- The U.S. aluminum industry urged President Trump to exclude Canadian aluminum from tariffs, aiming to safeguard jobs and domestic manufacturing.

- Over the weekend, President Trump said he plans to announce 25% tariffs on all steel and aluminum imports to the U.S.

By the numbers: Canada provides two-thirds of U.S. aluminum annually, and 90% of U.S. aluminum scraps are from Mexico and Canada due to limited domestic production capabilities to meet demand.

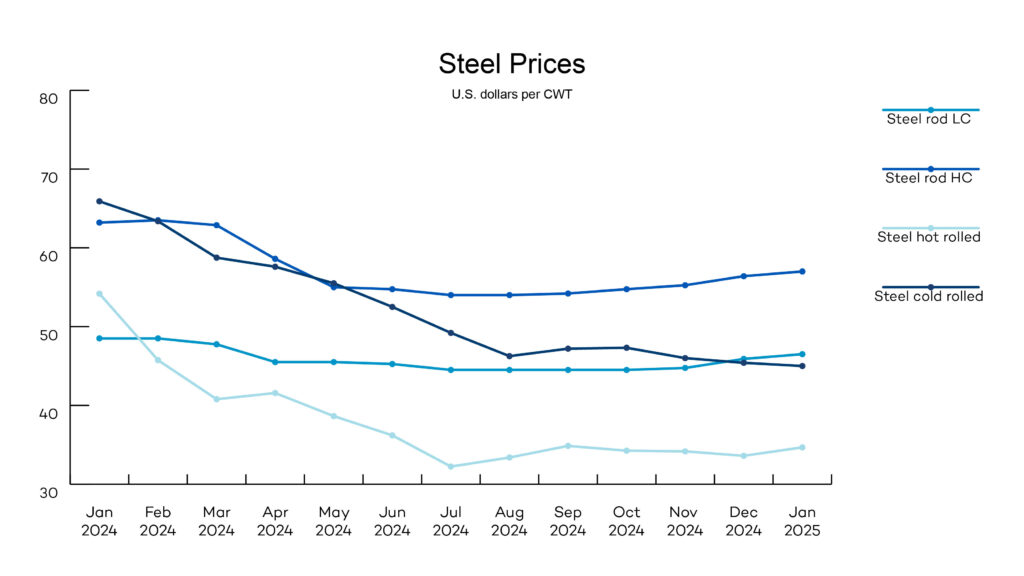

Steel prices increase amid tariff uncertainty

Steel suppliers announced a 10% price increase on February 3 in anticipation of the now paused 25% tariffs that could’ve impacted imported steel. More increases are expected throughout the year.

The big picture: Canada and Mexico are the largest suppliers of steel to the U.S., accounting for 35% of imports. The pause provides temporary relief for companies grappling with the prospect of higher costs. However, if these tariffs are implemented, it could bolster domestic steel prices and suppliers’ competitive edge.

More steel news: Nippon Steel’s purchase of U.S. Steel seems increasingly unlikely. The previous administration’s block, new administration’s stance, union opposition and legal challenges suggest the deal could be stalled indefinitely. However, President Trump said he would support Nippon Steel investing in U.S. Steel but not take complete ownership, creating a new opportunity for negotiations.

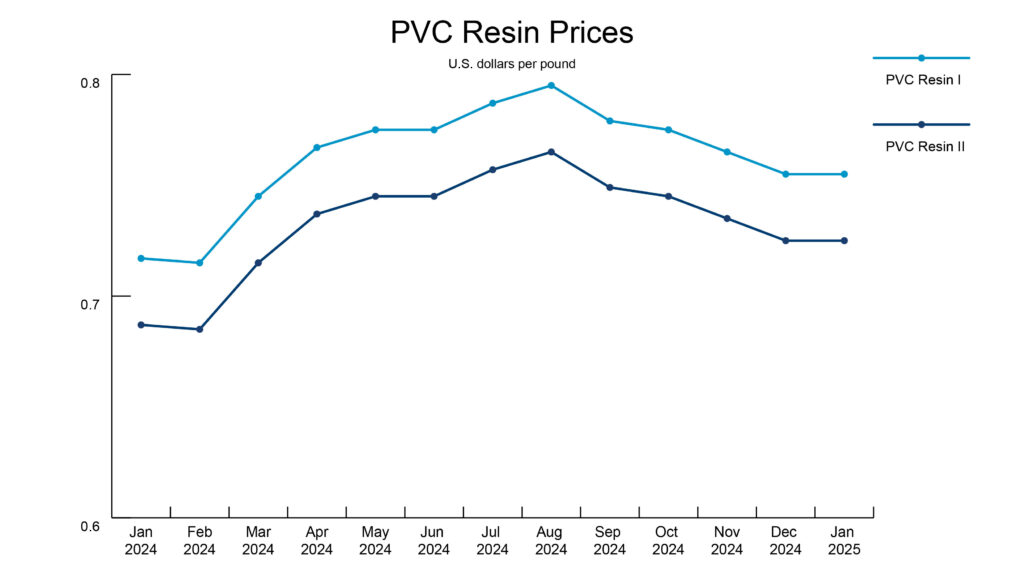

PVC prices dip despite cost pressures

Despite suppliers’ efforts to raise prices amid rising labor and transportation costs and growing demand, PVC prices are projected to fall throughout 2025.

Oil and resin costs remain stable. Storm season has had minimal impact on resin production. However, tariffs could influence oil prices in the coming months.

PVC pipe suppliers report healthy stock levels aside from larger diameter pipe and special radius bends, which have a lead time of approximately three weeks.

News roundup

The Federal Reserve (Fed) paused interest rate cuts in January amid economic policy uncertainty. The Fed’s next meeting is Tuesday–Wednesday, March 18–19.