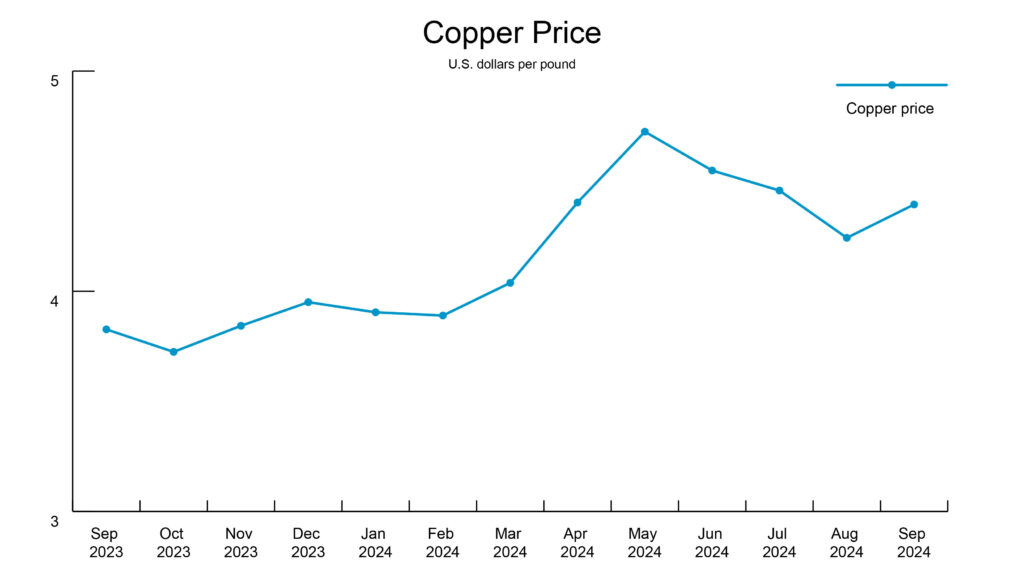

Copper's busy month

Copper wire had a busy September with three increases, opening at $4.35 this morning. Global demand for the red metal was strong due to the Federal Reserve’s (Fed) September interest rate cuts, China’s release of stimulus measures, increased imports and ongoing demand from electric vehicle (EV) production despite slower sales.

Between the lines: EV sales growth is regional, with some areas experiencing slower sales due to issues like disparities in the rollout of public charging stations. However, national EV registrations have surged by 142% since the beginning of 2023, showing that while sales are slowing, demand is still strong.

Yes, but: Copper is dipping at the start of October. After the U.S. job report came in better than expected, there is now speculation that the Fed may not cut rates in November as originally anticipated.

Why it matters: The strengthening of the dollar weakens the metal’s value, and China’s ambiguity over their stimulus packages is stirring doubt within the global market.

In other news: Copper smelters are warning of potential plant shutdowns if processing fees fall too low amid annual supply negotiations with miners. Smelters worry the fees could drop to unprofitable levels as new smelter investments in China have increased competition for copper ore, allowing for miners to demand more favorable terms.

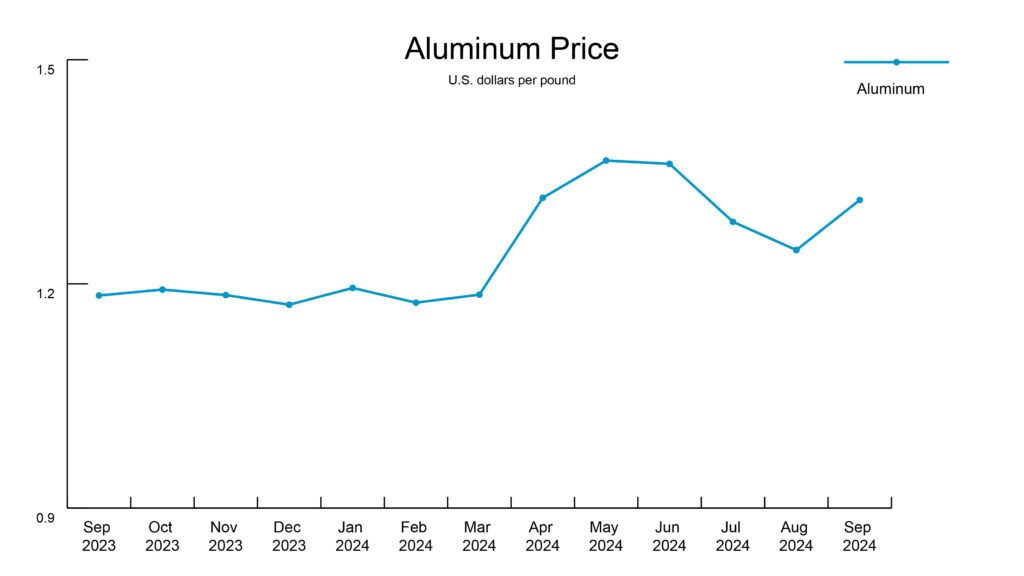

Aluminum wire's growing popularity

Today, aluminum opened at $1.34. Aluminum wire prices in October have risen from the September average. The growing demand for aluminum wire is driven by increased needs in energy infrastructure and EVs.

Why it matters: Aluminum is becoming a popular alternative to copper because it’s lighter, more resistant to corrosion and more cost-effective. Despite these advantages, copper wire remains a strong competitor because of its superior conductivity and the price of raw aluminum is more volatile than copper.

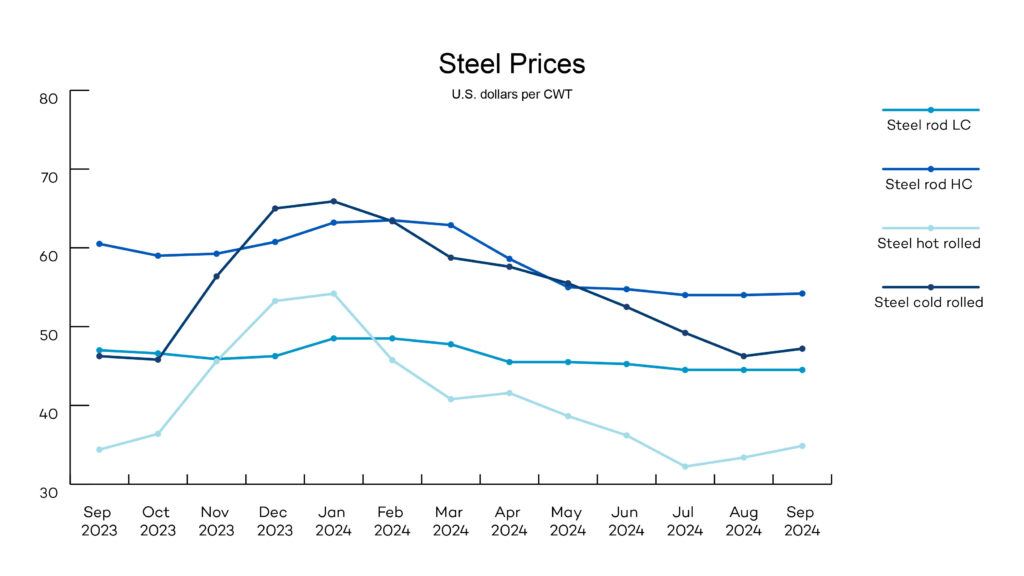

Steel pipe price increases gain support

Steel pipe suppliers retracted the 10% increase announced in early September and moved prices up 5% at the start of this month instead.

Why this matters: Support is growing with suppliers to align steel pipe prices with raw steel prices. With Section 301 tariffs one month into play and market speculation over the next Fed rate cut, this could be the time for the metal to make its move.

More steel news:

- Flatbed shipments are facing delays of 1–2 weeks due to the aftermath of Hurricane Helene.

- A surplus of imported steel pipe has accumulated following Hurricane Beryl’s impact on Mexico’s Gulf Coast in early July. Many import steel vendors have trucks ready to ship as soon as the area is cleared.

- The United Kingdom’s steel industry is advocating for an extension of tariffs on Chinese steel, with the original protection measures set to expire in 2026.

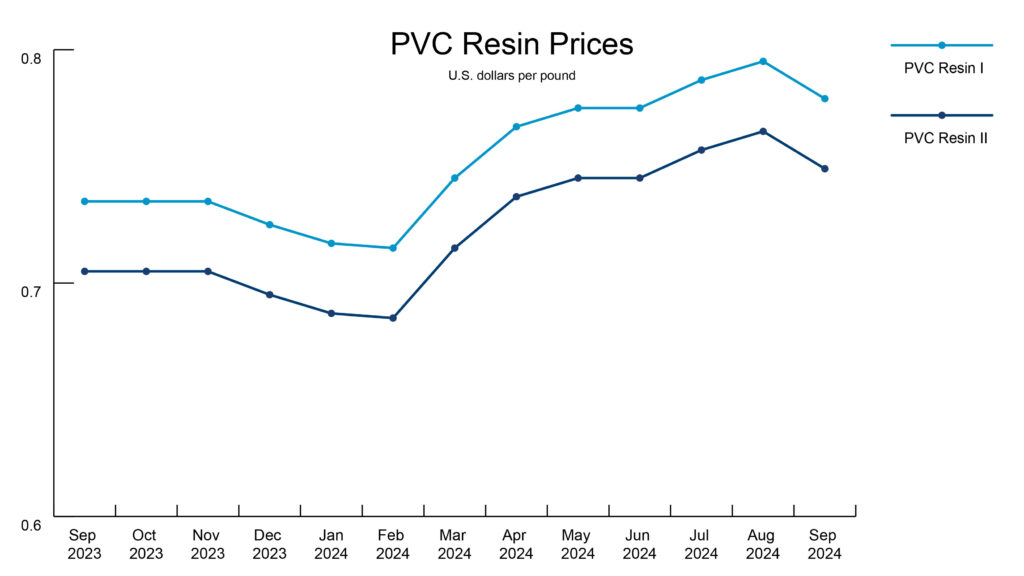

PVC remains steady

Lead times remain steady with good inventories available.

What we’re watching: An antitrust lawsuit filed by an electrical contractor that claims major PVC pipe manufacturers conspired to overcharge municipal and commercial buyers. Border States is monitoring this closely.

News roundup

The Canadian Government imposed a 25% tariff on Chinese aluminum and steel products. The tariffs were originally announced in August and will take effect on Tuesday, October 15.

The European Union will impose new 45% tariffs on Chinese EVs that will apply for the next five years.

Hurricane Helene made landfall in Florida’s Big Bend area as a Category 4 hurricane in late September, causing severe flooding across six states in the southeastern U.S. Hurricane Milton made landfall on October 9 as a Category 3 hurricane along the western coast of Florida’s peninsula, bringing heavy rain, powerful winds and tornadoes across the state and leaving over 300,000 customers without power as of this morning. All Border States’ employee-owners in the affected areas are accounted for. The regions will require extensive cleanup and infrastructure repairs. We’re in close contact with core suppliers, other vendors and logistics teams to minimize supply chain disruptions and maintain customer service. Our manufacturers in the hurricane’s path evacuated employees and shut down facilities. Some production facilities in Florida may resume operations as early as October 12, though extended lead times are possible. We will continue to monitor the situation and maintain contact with vendors for the coming months. Our thoughts go out to all those impacted by Hurricane Helene and Milton’s devastation — we’re all in this together.

The International Longshoremen Association and the United States Maritime Alliance reached a tentative deal to extend their master contract, ending a three-day strike along East and Gulf Coast ports on October 3, returning to work on October 4. Both parties will renegotiate on Wednesday, January 15, 2025.

The Fed cut interest rates by half a point in September. The Federal Open Market Committee will meet on Wednesday–Thursday, November 6–7.